- Joined

- 21 December 2013

- Posts

- 232

- Reactions

- 83

I'm not sure if the ASX will 'tank', yet I a global pull back seems likely / which will draw the ASX to follow.

A chart I like to follow, although I'm sure it will hold of little value for most, the CAPE index seems to offer some insight as to whether US equities are over bought.

We're currently above GFC levels and approaching dot com level's.

Hopefully some buying opportunity present if the ASX does 'tank'.

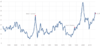

VIX hasn't seen any volatility for some time now, maybe this 'trade war'will kick things off?

A chart I like to follow, although I'm sure it will hold of little value for most, the CAPE index seems to offer some insight as to whether US equities are over bought.

We're currently above GFC levels and approaching dot com level's.

Hopefully some buying opportunity present if the ASX does 'tank'.

VIX hasn't seen any volatility for some time now, maybe this 'trade war'will kick things off?