You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The official "ASX is tanking!" panic thread

- Thread starter RexBudman

- Start date

-

- Tags

- asx asx tanking panic

- Joined

- 1 October 2008

- Posts

- 3,733

- Reactions

- 391

Can't imagine a relief rally happening here after (our universal Master) Wall Streets continued desperate sell off last night. Who put them in charge anyway?

Clearly imagining is not your thing!

Wysiwyg

Everyone wants money

- Joined

- 8 August 2006

- Posts

- 8,428

- Reactions

- 284

Correct and good for me.Clearly imagining is not your thing!

- Joined

- 9 June 2011

- Posts

- 1,926

- Reactions

- 483

Not sure where to post this.

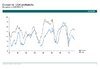

Data since 2000

Earnings yield is the inverse of the ASX 200 P/E ratio

Market Premium is Earnings Yield - 10 year bond yield

I'm not great with this sort of thing but with the recent sell off we are starting to get 'out there' a little bit in terms of return distribution. Green line is where the market is at as at 01/01/19. Once can draw there own conclusions however since 2000 it's been an OK bet buying something and putting it in the bottom draw at this point historically.

This is where I need the smart guys in the room to step in!

@systematic

@craft

- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

View attachment 91162

Not sure where to post this.

Data since 2000

Earnings yield is the inverse of the ASX 200 P/E ratio

Market Premium is Earnings Yield - 10 year bond yield

I'm not great with this sort of thing but with the recent sell off we are starting to get 'out there' a little bit in terms of return distribution. Green line is where the market is at as at 01/01/19. Once can draw there own conclusions however since 2000 it's been an OK bet buying something and putting it in the bottom draw at this point historically.

This is where I need the smart guys in the room to step in!

@systematic

@craft

Hi @kid hustlr,

P/E on it's own is not going to make you a good valuation measure and especially not as a comparator for "equity risk premium" calculations.

Suggest you read up a bit on this :

https://www.hussmanfunds.com/wmc/wmc171009.htm

https://hussmanfunds.com/wmc/wmc070820.htm

What you'll see is that at a bare minimum, you really need to adjust the E for profit margins which are cyclical.

Generally speaking at the index level there are some better (as in, very high correlation to long term future returns) shorthand tools you can use. A few are demonstrated here:

https://www.hussmanfunds.com/wmc/wmc140414.htm

https://www.hussmanfunds.com/wmc/wmc130318.htm

Shorthand Shiller PE model: 1.063 * (15 / ShillerPE)^(1/10) – 1 + Dividend_yield (decimal)

In this case, 6.3% is the long term nominal peak-to-peak or trough-to-trough growth in S&P500 earnings and 15 is the long term average of the Shiller PE for S&P500. You'd need to sub those values with ASX appropriate ones.

But if you plug those numbers in for the US you get:

1.063 * (15/28.21)^(1/10) -1 + 0.021 ~= 0.01893460284280889128

i.e. the current forecast 10Y annual return for the S&P500 is 1.89%/pa.

Plug that into the Sharpe ratio calculation using the 10Y US Gov bond yield and long term historical volatility of 15% you get:

(100*(1.063 * (15/28.21)^(1/10) -1 + 0.021) - (100*0.02689)) / 15 ~= -0.05303598104794072478

...negative forecast Sharpe ratio.

- Joined

- 8 June 2008

- Posts

- 13,223

- Reactions

- 19,513

So bonds and cash...

- Joined

- 9 June 2011

- Posts

- 1,926

- Reactions

- 483

Hi @kid hustlr,

P/E on it's own is not going to make you a good valuation measure and especially not as a comparator for "equity risk premium" calculations.

Suggest you read up a bit on this :

https://www.hussmanfunds.com/wmc/wmc171009.htm

https://hussmanfunds.com/wmc/wmc070820.htm

What you'll see is that at a bare minimum, you really need to adjust the E for profit margins which are cyclical.

Generally speaking at the index level there are some better (as in, very high correlation to long term future returns) shorthand tools you can use. A few are demonstrated here:

https://www.hussmanfunds.com/wmc/wmc140414.htm

https://www.hussmanfunds.com/wmc/wmc130318.htm

Shorthand Shiller PE model: 1.063 * (15 / ShillerPE)^(1/10) – 1 + Dividend_yield (decimal)

In this case, 6.3% is the long term nominal peak-to-peak or trough-to-trough growth in S&P500 earnings and 15 is the long term average of the Shiller PE for S&P500. You'd need to sub those values with ASX appropriate ones.

But if you plug those numbers in for the US you get:

1.063 * (15/28.21)^(1/10) -1 + 0.021 ~= 0.01893460284280889128

i.e. the current forecast 10Y annual return for the S&P500 is 1.89%/pa.

Plug that into the Sharpe ratio calculation using the 10Y US Gov bond yield and long term historical volatility of 15% you get:

(100*(1.063 * (15/28.21)^(1/10) -1 + 0.021) - (100*0.02689)) / 15 ~= -0.05303598104794072478

...negative forecast Sharpe ratio.

thanks

FWIW I tried to quote you also in this thread but I couldnt work out how to spell your bloody name

- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

So bonds and cash...

...and maybe some gold?

Depending on your portfolio construction, it can be alright to hold equities even when valuations are high, because if you're maintaining constant weights, you're selling into valuation expansions and buying valuations compressions...

- Joined

- 9 June 2011

- Posts

- 1,926

- Reactions

- 483

investo Boy,

A couple of quick points:

- Those Hussman articles are 5 years old and the market is far higher than what they were predicting

- Have you read this?

https://personal.vanguard.com/pdf/s338.pdf

A couple of quick points:

- Those Hussman articles are 5 years old and the market is far higher than what they were predicting

- Have you read this?

https://personal.vanguard.com/pdf/s338.pdf

- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

- Those Hussman articles are 5 years old and the market is far higher than what they were predicting

After 20+ years of outperforming Hussman badly underperformed since the GFC bottom (despite convincingly calling the bottom). Does that make the information wrong? Well, I'll leave that with you to read some more of his writings and think about.

If valuations were the only dictator of stock returns then we would never see equities become overvalued or undervalued. One thing that is obvious looking at market indexes historically is that overvalued markets can keep getting more overvalued and undervalued markets can keep getting more undervalued.

Did you know the Nikkei 225 had a CAPE of over 80 in the year 1990, just before the longest bear market in recent history? Or that S&P 500 had a CAPE of just a tad over 5 in 1982, just before US equities began one of the greatest bull markets of all time?

What's evident is that:

- Historically, valuations have proved extremely useful at predicting long run returns. Given that equities are a claim on a long run of future cash flows, this shouldn't be too surprising.

- Valuations are subsumed by investor sentiment in the short run and can over or under shoot (see here )

- Extreme over/undershoot on valuation expectations has historically led to extreme under/outperformance in the opposite direction going forward.

Anything could happen. Maybe investors will go crazy and bid equities up to CAPE of 80+ like they did in Japan in the 80s.

If they did, would that make equities at the current valuation good investment? Were US equities in 2013 a good investment, just because in hindsight "the market is far higher"? Were tech stocks a good investment in 1998?

Some people on this forum definitely have no issue riding a wave like that and will convincingly tell you they'll even be able to get out near the top.

My own strategy is to maintain a constant equity exposure as a % (25% to be precise) of my total portfolio, so while I'm long I'm periodically selling into insanity and buying despair.

Yup I did read it a long time ago.

- Joined

- 9 June 2011

- Posts

- 1,926

- Reactions

- 483

Investo, I really appreciate these chats. Some comments/questions:

- 25% Equities seems low? I like the balancing aspect of your portfolio. How old are you (if I can ask that??)

- my key takeaway from the discussion above is that earnings multiples do matter but's its just not that simple due to a variety of factors. Long term the numbers do show that accumulating more aggressively when stocks are at a low CAPE ratio may be beneficial.

I personally subscribe to the Vanguard position of 'slowly accumulating consistently over a long period of time to achieve a roughly average return' with 2 caveats:

- I will try to be slightly more aggressive at perceived very low multiples assuming my personal circumstance allows

- I allocate a portion of my funds to trading to try to 'beat the market'

At some stage I'll need to assume a % in bonds/defensive but my view is I am far too young to take this approach at present.

Logique

Investor

- Joined

- 18 April 2007

- Posts

- 4,290

- Reactions

- 768

Yes I noticed that 25% in equities as well. Perfectly understandable in the current down market, but over the long term, it doesn't seem much

- Joined

- 8 June 2008

- Posts

- 13,223

- Reactions

- 19,513

No

When demographic are taken into account, a wise position in europe us..to a lower extend in Australia imho

Not much but you would have made a killing in Japan..Yes I noticed that 25% in equities as well. Perfectly understandable in the current down market, but over the long term, it doesn't seem much

When demographic are taken into account, a wise position in europe us..to a lower extend in Australia imho

- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

- 25% Equities seems low?

It's a 25% envelope for equity strategies/portfolios within a larger envelope that consists of identical allocations to cash, gold, bonds. Each being an envelope for strategies/portfolios on that asset/class. e.g. one month I might be 25% US Equity Momentum and the next month 25% Europe Value. In cash I might be USD, EUR, AUD, CNY depending. Bonds might be Gov or Corp, shifting up and down duration, etc. Gold is pretty much just gold although the beta of gold to various macro factors changes over time without me needing to do anything (right now mostly real rates)

You can get an idea of why I might pursue this strat by looking at https://allocatesmartly.com/tactical-permanent-portfolio-gestaltu-investresolve/

I like the balancing aspect of your portfolio

See https://gestaltu.com/2012/02/volatility-harvesting-and-the-importance-of-rebalancing.html/

How old are you (if I can ask that??)

33 or 34 I think.

I personally subscribe to the Vanguard position of 'slowly accumulating consistently over a long period of time to achieve a roughly average return'

When it comes to equities, people are conditioned to believe that they go up, and Vanguard can market this effectively largely because in the US and a few other lucky places, they have.

But this strategy is only going to work if the underlying businesses are profitable over the long term and you aren't paying too much more than the businesses are worth. What "accumulating consistently over a long period of time" is, is a bet. It's a bet that the underlying businesses remain profitable and that you're not overpaying. And Vanguard looks smart because that bet has paid off.

I don't think that marketing strategy would work for index fund investors in Japan, or Greece, Spain, Italy, etc.

Maybe we'll be as lucky as the last 50+ years were and businesses will stay as profitable and on offer for decent prices for another 50. Then all the "Bogleheads" and FIRE people will look smart. Maybe it won't turn out like that at all (debt, demographics, growth, profitability, etc).

Since I don't know, I try and pay a bit more attention than that.

At some stage I'll need to assume a % in bonds/defensive but my view is I am far too young to take this approach at present.

I guess it's not surprising since this is a stock forum but I don't think most people understand precisely how bonds work in the global financial system or how they are priced.

- Joined

- 3 April 2013

- Posts

- 1,056

- Reactions

- 269

It's a 25% envelope for equity strategies/portfolios within a larger envelope that consists of identical allocations to cash, gold, bonds. Each being an envelope for strategies/portfolios on that asset/class. e.g. one month I might be 25% US Equity Momentum and the next month 25% Europe Value. In cash I might be USD, EUR, AUD, CNY depending. Bonds might be Gov or Corp, shifting up and down duration, etc. Gold is pretty much just gold although the beta of gold to various macro factors changes over time without me needing to do anything (right now mostly real rates)

As we have discussed before I do see the value in the approach being discussed

BUT

Are you not now strategy picking (within your envelopes) instead of stock picking? Bit hard to back test your dynamic system, and compare it to the very systematic approaches discussed in the papers above.

- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

Are you not now strategy picking (within your envelopes) instead of stock picking? Bit hard to back test your dynamic system, and compare it to the very systematic approaches discussed in the papers above.

Correct, but the turnover on strategies is quite low!

That said, I'm constantly learning and reading about strategies, investment managers, investment products, etc. If I find something I feel is a better option after due diligence and consideration of long term risks then I will switch at my discretion.

What I'm talking about is factor exposure and trend/volatility management and these days a lot of ETFs and managed funds which wrap those kind of things are popping up in the US markets.

So you could backtest using those for a decent approximation.

- Joined

- 15 November 2006

- Posts

- 1,206

- Reactions

- 679

When it comes to equities, people are conditioned to believe that they go up, and Vanguard can market this effectively largely because in the US and a few other lucky places, they have.

But this strategy is only going to work if the underlying businesses are profitable over the long term and you aren't paying too much more than the businesses are worth. What "accumulating consistently over a long period of time" is, is a bet. It's a bet that the underlying businesses remain profitable and that you're not overpaying. And Vanguard looks smart because that bet has paid off.

I've never heard this theory before. I think this is an odd way to look at equity markets & index funds. If you believed that it's "only a bet" you may as well stick with cash, and maybe gold.

- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

I've never heard this theory before. I think this is an odd way to look at equity markets & index funds. If you believed that it's "only a bet" you may as well stick with cash, and maybe gold.

It’s not a theory!

If you believe that mindlessly investing in equities over time will always lead to “average returns” (whatever those are), because they did in the past in your lucky corner of the world it’s a bet that the businesses you’re buying will remain profitable and you’re not overpaying.

The drivers of equity returns over the long run are well understood by academics and practitioners alike, there is no theoretical component.

- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

Some people just don’t really seem to grasp how lucky we are.

- Joined

- 9 June 2011

- Posts

- 1,926

- Reactions

- 483

Investo,

This is really good stuff. It's interesting comparing your thoughts/comments to some of the work Craft has put on this forum in the past regarding long term results/returns and his viewed preferred approach.

I have 2 underlying views:

- The more you know about this stuff the more you should touch your portfolio

- The majority of people who play the market are likely too aggressive/exposed whilst the those who know nothing about the market are likely heavily under-exposed

I'll admit the demographic factors you mentioned play on my mind to a degree and I think a long term investor can do several small things to 'tilt the odds' in their favour a fraction however the more i learn the more I like a consistent, long term approach based largely around equities.

I thank my lucky stars every day

This is really good stuff. It's interesting comparing your thoughts/comments to some of the work Craft has put on this forum in the past regarding long term results/returns and his viewed preferred approach.

I have 2 underlying views:

- The more you know about this stuff the more you should touch your portfolio

- The majority of people who play the market are likely too aggressive/exposed whilst the those who know nothing about the market are likely heavily under-exposed

I'll admit the demographic factors you mentioned play on my mind to a degree and I think a long term investor can do several small things to 'tilt the odds' in their favour a fraction however the more i learn the more I like a consistent, long term approach based largely around equities.

Some people just don’t really seem to grasp how lucky we are.

I thank my lucky stars every day