Modest

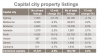

It's in the chart

- Joined

- 7 September 2012

- Posts

- 2,212

- Reactions

- 480

Pete Wargent @PeteWargent

Darwin dwelling values now where they were 7 years ago; Perth dwelling values retraced to 2007 levels

http://corelogic.com.au/news/capita...n-september-to-be-2-9-higher-over-the-quarter … #ausbiz

Wowzer thanks for posting that Joules! I am surprised MSM hasn't made a big deal out of those Perth figures... Ohh wait all the MSM outlets have vested interest in property rising!