- Joined

- 21 June 2009

- Posts

- 5,880

- Reactions

- 14

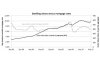

My understanding is pretty much the gang of 4 + the regionals are all glorified building societies with over 60% of loans for residential mortgages.

Got any proof? Are you saying that the big 4 banks have 60% market share or are you saying thier lending books consist of 60% of residential home loans?

Meanwhile back in reality:-

The financial regulator says it is "working assertively" with banks to make sure they do not slash their home lending standards to chase more business.

The Australian Prudential Regulation Authority's chairman John Laker has told an economics lecture that banks need to remember the lessons of the US housing meltdown.

He says bank directors have assured him that lending standards are being maintained and APRA audits have not found any major problems, despite some major banks now advertising 5 per cent deposit home loans.

"We are pathologically worried about poor credit standards if they became pervasive," he said.

http://www.abc.net.au/news/2013-11-27/apra-working-with-banks-on-lending/5119022

1) RBA lowers interest rates AGAIN

2) Unemployment rising

3) FIRB relaxation of policy (read Asian purchasing)

4) ???? ... anybody care to comment?

Number 4 ladeeez and generalmen ....

4) Lending standards (is the answer)

With economists predicting a rate REDUCTION in 2014 then the market is CERTAINLY showing signs of heading South. WHY ? Because the more banks lend at low rates and 95% LVR the more likely a default or mortgage in possession will result. What happens to prices then? A FIRE SALE results which then sends confidence tumbling as well as resulting in the banks tightening their lending ..... blah blah blah .... bored yet?