- Joined

- 5 January 2008

- Posts

- 556

- Reactions

- 0

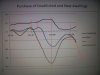

You can see the effect of that in the latest Housing Finance figures. Looking a little bit bearish aren't they.People rely on higher and higher LVR to fuel increasing prices. Also, the way LVRs work means that 90 -> 80 makes a HUGE dent in what someone can borrow, just as it made for huge increases on the way up.