ETF trick: I am only going to be buying quality ETFs that pay distributions (just like dividends for stocks but for funds they are called distributions) that I am happy to hold long term. Basically, buy when I have some excess cash or DCA with small sums and just hold with Warren Buffet's investment horizon. Do you guys see the trick, I hope you do. In case you missed it, let me spell it out:

When you do your taxes there are Capital Gains Tax events that you have to declare in that FY. A CGT event only occurs when you sell an asset, in my case those ETFs that I bought Low and sold High. But any ETFs that I purchase going forward is not going to be sold, hence no CGT event and therefore I won't get bent over. Distributions will be subject to tax, but some ETFs will have franking, so I will lean towards those.

ETFs can have Capital Gains whether you sell or not.

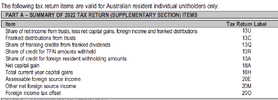

Snap shot of the components to include in a personal tax return (VAS 2021 annual tax statement.). The internal CG was quite high that year.

Same with VGS where there was some CG as well.

You can check the distribution tax components for each distribution by searching the ASX announcements. Here is the link to the distribution tax estimates for VAS for the October 2022 distribution.

https://cdn-api.markitdigital.com/a...ess_token=83ff96335c2d45a094df02a206a39ff4for

Also, some I understand (I think it was VDHG but I cannot be sure) can have large CG due to rebalancing or a whale cashing out of the wholesale funds. I believe there was a lot of hand wringing back at one stage when the yearly distribution was quite high.