- Joined

- 10 December 2012

- Posts

- 3,632

- Reactions

- 9

On these two points at least, I am in agreeance with you Syd. I was very disappointed with the coalition's attitude on house prices and middle class welfare has been a burr under my saddle blanket for the longest time.

Then can people start judging the current Government by their actions, not by some rose tinted belief they are better than Labor?

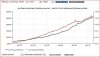

If Hockey Ponzinomics was hinting at reasonable reform on middle class welfare and taxation, I'd be quite happy and willing to believe we've had a change for the better, but on the current words of wisdom coming from them, it feels like they're hoping for another debt binge similar to 2000-2005 to lift the economy, but the household sector is still too indebted to take on much more. Australian households have barely deleveraged over the last 5 years, and that's with the savings rate back to 10% after being negative for a few years under Howard .

It's going to be VERY hard to fill in the 6% GDP drop of the mining CAPEX cliff over the next 2.5 years, and there's still a decent level of overcapacity in the economy, so why invest when what we have isn't fully utilised? We have an over valued dollar, a central bank that thinks macro prudential policy is toxic, financial repression that is probably causing a bigger lose of income since only 1 in 3 households have a mortgage so the rest of us suffer lower incomes to support the over indebted.