- Joined

- 3 July 2009

- Posts

- 27,765

- Reactions

- 24,751

I raise several points and you have the nerve to carry on about my hurt feelings over the broken promise point, the press have covered the broken promises too so I'm not the only one who finds this government a bit hypocritical on this point but to carry on about my hurt feelings is just plain condescending. Drsmith had a sensible reply.

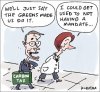

Here you go overhang, Alan Kohler explains the broken promises articulately, and why election promises are always broken.

http://www.abc.net.au/news/2014-05-15/kohler-budget-time-bombs-meant-lies-were-inevitable/5452348

Here is a paragraph from the article. My bolds

Broken promises are nothing new - they have been happening after every election since your correspondent first became a journalist in the early 1970s, and no doubt before that too