tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,454

- Reactions

- 6,521

Hindsight trading now is it? I mentioned a possible V-bottom at $1.34 (last I checked still in play) well before the techies arrived in the thread (and was subsequently told a four-year old could see that the trend was going down).

You freely give advice to others, whether they want it or not, I'm giving you some of your own to think about. I remember saying on the day that your entry looked arbitrary at best. Go check out the post.

In this case you changed your analysis after the fact and were a bit rash - it's an error of judgment that I am pointing out not a personal attack. I'm certainly not questioning your trading prowess.

OF course it's an error in judgement.

The analysis was proven wrong that's why stops are placed.

Thats what I like about. T/A you can be wrong more often than your right and still be profitable.

Short term analysis is a bar by bar process.

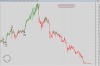

Longterm analysis for TGA is a prolonged down trend.

For the pleasure of Duck hunters

I get it wrong --- often

Aim however profitable --- often.

I minimize loss and where I can maximize gain.

It's called trading.