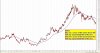

tech/a you've consistently referred to people purchasing at $2+ and sitting on losses instead of using risk mitigation but i'm not aware of anyone in here purchasing that high and holding unless i've missed something. The only person i've seen discussing the stock thats been on it since the $2.20 days is PiouPiou and hes already stated his reasoning for holding (was already at a reasonable gain, has a large holding delivering consistently high dividends on his cost base for a retirement income stream which he's happy with).

I totally agree with you that risk mitigation is essential and in my short time investing in shares have already made a number of mistakes in holding for too long and ending up with a reasonable loss. However most here are mitigating their risk with cost bases around $1.50-$1.60 which we see as a significant enough margin of safety to a generalised price target of anywhere between $1.80 to $2.60 (personally i think closer to $2.00 is about right).

Your correct, we could have a stop loss of say 10% on our purchase price of $1.50 (my avg cost base) which would mean im stopped out at $1.35. But in that case you need to wait to recognise another bottom which you can't see until you have the hindsight of a broken down trend which invariably may mean you end up buying back in at $1.30 anyway.

Anyway I think risk mitigation is essential and can see where your coming from, however I think your still hung up on margin of safety and valuations and that they are in your view, useless. It would be interesting to know the avg purchase price of everyone around here to see who actually did buy in at the $2 mark.

My avg purchase price - $1.508

I totally agree with you that risk mitigation is essential and in my short time investing in shares have already made a number of mistakes in holding for too long and ending up with a reasonable loss. However most here are mitigating their risk with cost bases around $1.50-$1.60 which we see as a significant enough margin of safety to a generalised price target of anywhere between $1.80 to $2.60 (personally i think closer to $2.00 is about right).

Your correct, we could have a stop loss of say 10% on our purchase price of $1.50 (my avg cost base) which would mean im stopped out at $1.35. But in that case you need to wait to recognise another bottom which you can't see until you have the hindsight of a broken down trend which invariably may mean you end up buying back in at $1.30 anyway.

Anyway I think risk mitigation is essential and can see where your coming from, however I think your still hung up on margin of safety and valuations and that they are in your view, useless. It would be interesting to know the avg purchase price of everyone around here to see who actually did buy in at the $2 mark.

My avg purchase price - $1.508