tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,400

- Reactions

- 6,317

Over 25 yrs I've studied a lot of what is available in the technical analysis field.

I've also worked for 2 yrs with people who are amazing with Data analysis and

coding on a level well beyond the capabilities of 99.95% of us. AI is the future

for those who can access it.

Does this mean we are all doomed --- I dont think so AI will be in a space we

will not go to it will find things that we cant see.--Just another player--a powerful

one at that.

While 80% of Technical Analysis is worth the time to become proficient in the Technical space.

Little is of practical value in ISOLATION.

I'm not going to enter into argument on which is best and which is rubbish.

Rather Ill concentrate on that which I have found as valuable in my own trading

What I look for and Why---you will then need to plot your own path--hopefully with

more purpose and Clear---er Direction.

Technical analysis at best leads you to a trading opportunity whether that be long or short.

Risk managements saves you from your own bias and the fallibility of any form of analysis.

Reward to risk on capital traded is your score card--the money follows.

The most powerful technical tool is the analysis of PATTERNS

Not the first to see this.

Gann

Elliott

Steidlmayer

Williams

Gartley

Edwards and McGee

Pring

Van Tharp

All looked at Patterns in their own way.

Patterns of meaning form in all sorts of DATA not just price.

Volume

Range

Seasonality

Open interest

Long and Short holders.

Course of Trades

Time

There Are Many more places to look.

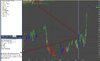

There are a great many patterns but by far

my favorite is Consolidations. In Price/Range/Volume

Everything happening IN Patterns leads to what Happens

OUTSIDE of Patterns.

More often than not it reads IN CONTEXT with clarity.

The value lies in

What happens in these patterns

Where it happens in a chart/data EG

After a prolonged move.

After a short move

After a wide range very high volume bar.

There are a lot more

When it happens in a chart/data

After a long period of time

Straight after another consolidation of size or Very small

Mondays-every May-

After High volume

After Low Volume

There are a lot more

Why it happens.

News.

Volume

World economics

Demand incoming or leaving.

Again many more.

But in every case ONE occurrence IN A pattern can trigger events to occur

outside the pattern and that's when you want to be on it!

The pattern as you will find in isolation has little value as they will fail just as often as

they conform to standard technical theory. Of little value when you want to trade the Chart/Data.

30-50% success maybe acceptable in some models but frustrating and useless to others.

Particularly those Trading in a discretionary manner.

The second Most powerful Tool is

The analysis of single Occurrences or Occurrence Clusters Inside or Outside of Patterns

Trends are patterns!

They can be

Single or Groups of Bars

Volume

News catalysts.

Chart Characteristics.

Time.

I've also worked for 2 yrs with people who are amazing with Data analysis and

coding on a level well beyond the capabilities of 99.95% of us. AI is the future

for those who can access it.

Does this mean we are all doomed --- I dont think so AI will be in a space we

will not go to it will find things that we cant see.--Just another player--a powerful

one at that.

While 80% of Technical Analysis is worth the time to become proficient in the Technical space.

Little is of practical value in ISOLATION.

I'm not going to enter into argument on which is best and which is rubbish.

Rather Ill concentrate on that which I have found as valuable in my own trading

What I look for and Why---you will then need to plot your own path--hopefully with

more purpose and Clear---er Direction.

Technical analysis at best leads you to a trading opportunity whether that be long or short.

Risk managements saves you from your own bias and the fallibility of any form of analysis.

Reward to risk on capital traded is your score card--the money follows.

The most powerful technical tool is the analysis of PATTERNS

Not the first to see this.

Gann

Elliott

Steidlmayer

Williams

Gartley

Edwards and McGee

Pring

Van Tharp

All looked at Patterns in their own way.

Patterns of meaning form in all sorts of DATA not just price.

Volume

Range

Seasonality

Open interest

Long and Short holders.

Course of Trades

Time

There Are Many more places to look.

There are a great many patterns but by far

my favorite is Consolidations. In Price/Range/Volume

Everything happening IN Patterns leads to what Happens

OUTSIDE of Patterns.

More often than not it reads IN CONTEXT with clarity.

The value lies in

What happens in these patterns

Where it happens in a chart/data EG

After a prolonged move.

After a short move

After a wide range very high volume bar.

There are a lot more

When it happens in a chart/data

After a long period of time

Straight after another consolidation of size or Very small

Mondays-every May-

After High volume

After Low Volume

There are a lot more

Why it happens.

News.

Volume

World economics

Demand incoming or leaving.

Again many more.

But in every case ONE occurrence IN A pattern can trigger events to occur

outside the pattern and that's when you want to be on it!

The pattern as you will find in isolation has little value as they will fail just as often as

they conform to standard technical theory. Of little value when you want to trade the Chart/Data.

30-50% success maybe acceptable in some models but frustrating and useless to others.

Particularly those Trading in a discretionary manner.

The second Most powerful Tool is

The analysis of single Occurrences or Occurrence Clusters Inside or Outside of Patterns

Trends are patterns!

They can be

Single or Groups of Bars

Volume

News catalysts.

Chart Characteristics.

Time.

Last edited: