You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Support & Resistance Basics

- Thread starter drillinto

- Start date

Learning how to trade

Source: Don Worden, The Worden Report(USA)

[Don received this comment from one of the subscribers to his daily report]

"Back in 1982, while I was within the process of training to become a stock broker, I was on the floor of the AMEX where I met an options specialist. I had been trading options since 1974. So, to meet an option's specialist to me was like meeting a rock star. Needless to say, I was full of questions and as one question lead to the next, the exchange closed trading for the day at which point I was invited to join my new mentor for a beer.

There are two very distinctive things I remember from that encounter. The 1st was the reply he gave me when I asked how he made his money. With beer in hand, he said "I never make big bets." I lean a little one way, as he tilted to the left, or I lean a little the other way as he tilted to the right. He repeated this swaying until his beer was gone.

After ordering another round, he turned toward me and said, "I'm going to give you the best piece of advice anybody will ever give you. I want you to take a $100,000 paper option account and try to lose all of the money." I started to laugh. He did not. He then said, looking me straight in the eyes, "You will not be able to do it." He said being a good trader is not about making money. Making money is about being a good trader. And being a good trader is about having the right rules to make a decision and then following those rules. So when you try to lose money, you are just as likely to fail as you are when you try to make money. The difference being in this exercise is to separate the two motivations.

Then he started to laugh and concluded his thought trend by saying, "When you finally have figured out how to lose consistently, and your paper portfolio is gone, you are now ready to trade. Simply flip the rules around and you'll have your money making trading system. And always remember one thing - that there are two sides to every trade. You just have to learn on which side to lean."

Source: Don Worden, The Worden Report(USA)

[Don received this comment from one of the subscribers to his daily report]

"Back in 1982, while I was within the process of training to become a stock broker, I was on the floor of the AMEX where I met an options specialist. I had been trading options since 1974. So, to meet an option's specialist to me was like meeting a rock star. Needless to say, I was full of questions and as one question lead to the next, the exchange closed trading for the day at which point I was invited to join my new mentor for a beer.

There are two very distinctive things I remember from that encounter. The 1st was the reply he gave me when I asked how he made his money. With beer in hand, he said "I never make big bets." I lean a little one way, as he tilted to the left, or I lean a little the other way as he tilted to the right. He repeated this swaying until his beer was gone.

After ordering another round, he turned toward me and said, "I'm going to give you the best piece of advice anybody will ever give you. I want you to take a $100,000 paper option account and try to lose all of the money." I started to laugh. He did not. He then said, looking me straight in the eyes, "You will not be able to do it." He said being a good trader is not about making money. Making money is about being a good trader. And being a good trader is about having the right rules to make a decision and then following those rules. So when you try to lose money, you are just as likely to fail as you are when you try to make money. The difference being in this exercise is to separate the two motivations.

Then he started to laugh and concluded his thought trend by saying, "When you finally have figured out how to lose consistently, and your paper portfolio is gone, you are now ready to trade. Simply flip the rules around and you'll have your money making trading system. And always remember one thing - that there are two sides to every trade. You just have to learn on which side to lean."

Trembling Hand

Can be found on the bid

- Joined

- 10 June 2007

- Posts

- 8,852

- Reactions

- 205

Drillinto that is truly one of the greatest posts I have read. If that sound sarcastic I am not trying to be I mean it. I have a list of trading quotes that I keep, that is going in it.

Drillinto that is truly one of the greatest posts I have read. If that sound sarcastic I am not trying to be I mean it. I have a list of trading quotes that I keep, that is going in it.

I second that.

Trembling Hand

Can be found on the bid

- Joined

- 10 June 2007

- Posts

- 8,852

- Reactions

- 205

His books are must-reads as well, not the usual

"Have a look at these static charts that I have found that fit to my system" kind of stuff.

Some real good insights as to what it takes to make it.

"Have a look at these static charts that I have found that fit to my system" kind of stuff.

Some real good insights as to what it takes to make it.

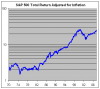

One should always adjust stock prices for inflation before declaring record highs

July 18, 2007

Economic Scene

Some Records Aren’t Worth the Hoopla

By DAVID LEONHARDT / New York Times

So have you heard the one about the stock market’s new record high?

Last Thursday, stocks had one of their best days in years, with the Dow Jones industrial average and the Standard & Poor 500-stock index both jumping about 2 percent. “A record day on Wall Street,” Brian Williams intoned that night at the top of the “NBC Nightly News” broadcast. “Stocks surging up to new highs.”

The next morning, newspapers around the world, including this one, made prominent mention of the record. The Wall Street Journal led its Friday paper with this headline: “Dow Again Soars to Record High Despite Unease.” Yesterday, the Dow cracked 14,000 for the first time, before closing at 13,971.

Technically, all the talk about records is accurate. But it’s also fundamentally wrong. In fact, the attention that’s being showered on “Dow 14,000” goes a long way toward explaining why our economy has become so susceptible to speculative bubbles.

The idea that stock prices tend to rise over time really should not be surprising. The price of almost everything rises over time, thanks to inflation. Each year, the federal government prints more money, which is the main reason that the price of groceries, cars, clothes and, yes, stocks keeps on going up. Incomes do, too.

These increases don’t mean, however, that everything is always getting more expensive and everyone is always getting richer (which would be a contradiction). And the stock market’s record high does not mean that stocks have been a wonderful investment lately. They haven’t been.

The S.& P. 500, which is a much better measure than the Dow, closed yesterday at 1,549, just 1.4 percent higher than the peak it reached in March 2000. Think about what that means. While the price of nearly everything has risen over the least seven years ”” while the price of bread has increased almost one-third, for instance ”” stocks have barely budged. They have only marginally outperformed cash sitting in a bureau drawer. So if we are going to talk about a stock market record, we should be doing the same for a whole lot of other things: Loaves of Bread Surge to New Highs

I realize that this point can sound like statistical nitpicking, but it actually relates to something quite important. When you overlook inflation, you can start to think that every investment is a can’t-miss investment, because its value always seems to be going up. This mistake, combined with the enormous attention that society now devotes to the value of its investments, helps create the conditions for a bubble.

A few years ago, I was interviewing a real estate agent in the Midwest, and she mentioned that her daughter had recently sold her house for 30 percent more than she had bought it for a decade earlier. “Where else can you get a return like that?” the agent asked. One answer, which I didn’t give, is a boring old savings account.

The only meaningful way to measure an investment is to strip away the distortions caused by inflation. You’re then able to focus on its real value ”” what it can buy in the marketplace ”” rather than just a number on a piece of paper. (A good rule of thumb is that something appearing to have doubled in price or value since the early 1980s costs the same now, in real terms, as it did then.) When you make these adjustments, it becomes obvious that stocks and real estate are by no means can’t-miss investments.

The average house in the New York region sold for roughly the same nominal price in 1997 as it had in 1988, which in inflation-adjusted terms means its value dropped 31 percent. House prices in New York didn’t exceed their 1988 real value until 2002. Then, of course, they soared like never before.

The stock market has suffered through even longer stretches of mediocrity. The S.& P. 500 first went over 100 in 1968. In today’s dollars, that means it was up near 600. It then entered a long period in which it failed to keep pace with inflation ”” leading to BusinessWeek’s famous 1979 cover article, “The Death of Equities” ”” and didn’t exceed its real 1968 high until 1992. Over the next eight years, it tripled, even after taking inflation into account.

Today, the S.& P. remains 17 percent below its inflation-adjusted 2000 peak. A share in a mutual fund tied to the S.& P. 500, in other words, can’t buy nearly as much today as it could in early 2000. Now, in a way, this might be considered a good sign. If the market isn’t really at a record high, it may still have a lot of running room. But I wouldn’t be too confident about that. Relative to corporate earnings, stocks remain more expensive than they have been at any time except the 1920s and the 1990s.

That’s the thing about bubbles: they usually take a long time to overcome. The normal pattern after a huge boom ”” like the sort we recently had in stocks and then real estate ”” is years if not decades in which an investment doesn’t keep up with savings accounts. And what kind of a record is that?

July 18, 2007

Economic Scene

Some Records Aren’t Worth the Hoopla

By DAVID LEONHARDT / New York Times

So have you heard the one about the stock market’s new record high?

Last Thursday, stocks had one of their best days in years, with the Dow Jones industrial average and the Standard & Poor 500-stock index both jumping about 2 percent. “A record day on Wall Street,” Brian Williams intoned that night at the top of the “NBC Nightly News” broadcast. “Stocks surging up to new highs.”

The next morning, newspapers around the world, including this one, made prominent mention of the record. The Wall Street Journal led its Friday paper with this headline: “Dow Again Soars to Record High Despite Unease.” Yesterday, the Dow cracked 14,000 for the first time, before closing at 13,971.

Technically, all the talk about records is accurate. But it’s also fundamentally wrong. In fact, the attention that’s being showered on “Dow 14,000” goes a long way toward explaining why our economy has become so susceptible to speculative bubbles.

The idea that stock prices tend to rise over time really should not be surprising. The price of almost everything rises over time, thanks to inflation. Each year, the federal government prints more money, which is the main reason that the price of groceries, cars, clothes and, yes, stocks keeps on going up. Incomes do, too.

These increases don’t mean, however, that everything is always getting more expensive and everyone is always getting richer (which would be a contradiction). And the stock market’s record high does not mean that stocks have been a wonderful investment lately. They haven’t been.

The S.& P. 500, which is a much better measure than the Dow, closed yesterday at 1,549, just 1.4 percent higher than the peak it reached in March 2000. Think about what that means. While the price of nearly everything has risen over the least seven years ”” while the price of bread has increased almost one-third, for instance ”” stocks have barely budged. They have only marginally outperformed cash sitting in a bureau drawer. So if we are going to talk about a stock market record, we should be doing the same for a whole lot of other things: Loaves of Bread Surge to New Highs

I realize that this point can sound like statistical nitpicking, but it actually relates to something quite important. When you overlook inflation, you can start to think that every investment is a can’t-miss investment, because its value always seems to be going up. This mistake, combined with the enormous attention that society now devotes to the value of its investments, helps create the conditions for a bubble.

A few years ago, I was interviewing a real estate agent in the Midwest, and she mentioned that her daughter had recently sold her house for 30 percent more than she had bought it for a decade earlier. “Where else can you get a return like that?” the agent asked. One answer, which I didn’t give, is a boring old savings account.

The only meaningful way to measure an investment is to strip away the distortions caused by inflation. You’re then able to focus on its real value ”” what it can buy in the marketplace ”” rather than just a number on a piece of paper. (A good rule of thumb is that something appearing to have doubled in price or value since the early 1980s costs the same now, in real terms, as it did then.) When you make these adjustments, it becomes obvious that stocks and real estate are by no means can’t-miss investments.

The average house in the New York region sold for roughly the same nominal price in 1997 as it had in 1988, which in inflation-adjusted terms means its value dropped 31 percent. House prices in New York didn’t exceed their 1988 real value until 2002. Then, of course, they soared like never before.

The stock market has suffered through even longer stretches of mediocrity. The S.& P. 500 first went over 100 in 1968. In today’s dollars, that means it was up near 600. It then entered a long period in which it failed to keep pace with inflation ”” leading to BusinessWeek’s famous 1979 cover article, “The Death of Equities” ”” and didn’t exceed its real 1968 high until 1992. Over the next eight years, it tripled, even after taking inflation into account.

Today, the S.& P. remains 17 percent below its inflation-adjusted 2000 peak. A share in a mutual fund tied to the S.& P. 500, in other words, can’t buy nearly as much today as it could in early 2000. Now, in a way, this might be considered a good sign. If the market isn’t really at a record high, it may still have a lot of running room. But I wouldn’t be too confident about that. Relative to corporate earnings, stocks remain more expensive than they have been at any time except the 1920s and the 1990s.

That’s the thing about bubbles: they usually take a long time to overcome. The normal pattern after a huge boom ”” like the sort we recently had in stocks and then real estate ”” is years if not decades in which an investment doesn’t keep up with savings accounts. And what kind of a record is that?

Trembling Hand

Can be found on the bid

- Joined

- 10 June 2007

- Posts

- 8,852

- Reactions

- 205

If you are going to use inflation as an input to compare absolute highs then you would think you should also include dividends? As the author of that stated article did for his savings account but failed to do it on the stocks side of the equation and when does a savings account beat inflation by more than a couple of percent per year? Where stock markets often make big inflation-adjusted gains.

Trembling Hand

Can be found on the bid

- Joined

- 10 June 2007

- Posts

- 8,852

- Reactions

- 205

Just stumbled onto this from www.crossingwallstreet.com blog

The S & P 500 Adjusted For Inflation PLUS dividends, this is the way to do it.

The S & P 500 Adjusted For Inflation PLUS dividends, this is the way to do it.

Attachments

ASX Back Above 6,100, Australia and US at Point of Economic Divergence

by Dan Denning - Aug 9th, 2007

Australia’s ASX/200 is back above 6,100. Despite the correction, it is the best of times. Local investors focused on Glenn Steven’s remarks yesterday that, “High world commodity prices remain an important source of stimulus to Australia’s national income and spending.” You can say that again, guv.

Stevens’ remarks show that Australia and the US may now find themselves at a point of economic divergence. In the US, the bearded Ben Bernanke denied the credit junkies on Wall Street a rate-cutting fix earlier this week. Already worried about the dollar’s six-year slide on global currency markets, Bernanke fears inflation and an even more pronounced decline in the greenback. American stocks again rallied in a strange and somewhat suspicious late afternoon trading pattern. But is the American market headed toward the worst of times?

Stevens, meanwhile, also fears inflation. But the inflation he fears in Australia is largely driven by tight labour markets, business spending on capacity expansion, and government spending on infrastructure (and lots of other election year goodies.). True, high borrowing levels by the consumer are also driving inflationary fears. But when it comes right down to it, Australia’s economy is clearly hitched to the China wagon, and that seems to be good news for the earnings potential of local shares, both financials and miners alike. Stevens is worried about sustainable growth, Bernanke about hyper-inflation and/or a credit market meltdown.

The Daily Reckoning Australia

www.dailyreckoning.com.au

by Dan Denning - Aug 9th, 2007

Australia’s ASX/200 is back above 6,100. Despite the correction, it is the best of times. Local investors focused on Glenn Steven’s remarks yesterday that, “High world commodity prices remain an important source of stimulus to Australia’s national income and spending.” You can say that again, guv.

Stevens’ remarks show that Australia and the US may now find themselves at a point of economic divergence. In the US, the bearded Ben Bernanke denied the credit junkies on Wall Street a rate-cutting fix earlier this week. Already worried about the dollar’s six-year slide on global currency markets, Bernanke fears inflation and an even more pronounced decline in the greenback. American stocks again rallied in a strange and somewhat suspicious late afternoon trading pattern. But is the American market headed toward the worst of times?

Stevens, meanwhile, also fears inflation. But the inflation he fears in Australia is largely driven by tight labour markets, business spending on capacity expansion, and government spending on infrastructure (and lots of other election year goodies.). True, high borrowing levels by the consumer are also driving inflationary fears. But when it comes right down to it, Australia’s economy is clearly hitched to the China wagon, and that seems to be good news for the earnings potential of local shares, both financials and miners alike. Stevens is worried about sustainable growth, Bernanke about hyper-inflation and/or a credit market meltdown.

The Daily Reckoning Australia

www.dailyreckoning.com.au

US Expansions and Recessions: 1900-2007

http://bespokeinvest.typepad.com/bespoke/2007/09/the-business-cy.html

http://bespokeinvest.typepad.com/bespoke/2007/09/the-business-cy.html

Pertinent comment for OZ

************

Hamish McRae: The greatest boom the world has ever seen

Published: 05 September 2007 | The Independent, London, UK

Beijing: China's pre-Olympics economic boom has ratcheted up a few clicks. With less than a year to run, it is not just the main stadium site that is humming; the entire city is a great building site. Not only is it rushing to complete new hotels and other facilities ahead of the games, it is also sprucing itself up: fixing pavements, repainting shopfronts, opening restaurants.

You can measure the China boom in the statistics – growth running at more than 11 per cent in the first half of this year – but nothing can prepare the visitor for the actuality. This is not just the greatest boom on earth at the moment – it is the greatest boom the world has ever known. In 2005, China passed the UK to become the world's fourth-largest economy; either this year or next, it will pass Germany to become the world's third largest. It is hard not to see it passing Japan to become the second largest within about a decade, and then it is at least plausible that within a generation it will pass the United States to become the biggest.

Most of us are vaguely aware of this, just as we are aware that, thanks largely to China, the world economy has, over the past five years, had its fastest growth ever recorded. We also can see, and this is more troubling, the pressure that this growth has put on world resources. We see it not just in the price of oil and minerals, but also of basic foodstuffs such as meats, wheat and maize.

Naturally, this is troubling China too: the main reason why inflation has shot up to more than 5 per cent is the rising cost of food, something that has its harshest impact on its urban poorest. The most extreme example I have found is the price of pork, which, partly as a result of an illness in pigs called blue ear that has cut supplies, is 75 per cent higher than a year ago.

We are also aware that there has been huge environmental degradation as a result of rapid industrialisation. Horror stories abound, including a million people losing their drinking water because of pollution from factories. Actually, the air in Beijing this week seems rather better than it was on my last visit a year ago, and much better than, say, Edinburgh in the 1950s. But the point was made forcibly to me this week at a meeting with top bankers, that China would clean up the environment because it had to for the health of its people. It would not pay any attention to what the West urged upon it. Incidentally, there is one big public health lesson we can learn from China: virtually the only obese people you see are tourists. China has so far avoided what is arguably the greatest single threat to health in the West.

There is a wider point here. China is industrialising on pretty much the same model as the various western economies did a century or more earlier, the key driver being a surge in manufactured exports. But there are three crucial differences. It is making the transformation much more swiftly. It affects vastly more people, some 20 per cent of humankind, than even the industrialisation of the United States. And it is happening at a time when many of the world's natural resources – from fish stocks to oil – are reaching limits of sustainability, and, in some cases, exceeding them.

Viewed rationally, this is not sustainable. That is accepted. One of our hosts pointed out that were China to reach Western levels of car ownership, they would use more fuel than the entire output of the world. But that has not stopped China building a motor industry that will become the world's largest within about five years, or pricing petrol at one-third of UK levels. China became a net importer of oil in the 1990s, and this year it is in the process of becoming a net importer of coal, too. But rather than be a pioneer in conservation, it has headed out into the world, doing deals – particularly with African countries – to try to secure supplies. This may give it some modest measure of greater security in the short-term, but oil is oil. There is a finite amount of the stuff, and such deals do little to increase the global supply.

Meanwhile, to price petrol so cheaply is nuts: poor farmers who need to buy it could be helped in other ways. "I agree," said a senior banker, "but I am not the government."

There is something else that is not sustainable. That is the trade imbalance between China and the US. You can hear the rumblings in Congress; the candidates in next year's presidential election will be forced to adopt a more protectionist stance. The modest and gradual revaluation of the yuan, forced on China by the US, has failed to cut the deficit; indeed, it seems to have had hardly any impact at all. So this problem will not go away.

The Chinese point out that their exports to the US are rising more slowly than their exports to Asia, which are rising by about 50 per cent a year. They point out that they have been responsible holders of US Treasury securities, in effect financing the trade gap. And, of course, it is Americans who buy the imports and, largely, American companies that help produce them, through licences and joint ventures. But these arguments won't play strong in Congress.

These coming months, the run-up to the Olympics will, I think, be crucial in the relations between China and the rest of the world. China is on display and will want to impress. Given the extraordinary achievements of the past 30 or so years, it will indeed dazzle the world. But it needs not just to dazzle but to build a harmonious relationship with its trading partners: to adopt a measured response commensurate with its power.

One of the most surprising aspects of being a Briton in China is periodic emergence of a curious victim mentality. We were reminded of Britain's role in selling opium to China. Er, yes, that was 150 years ago. Official tours of Shanghai, a wonderful city that was in some measure the creation of western businesses, remind people of the unequal treaties that gave western countries concessionary areas. Talk of the environmental cost of rapid industrialisation and you are told that this is really the responsibility of the Americans who buy their toys from Chinese factories.

It is all a bit odd. There is so much to admire about this ancient civilisation which, by the way, Londoners can catch a glimpse of when the terracotta warriors are exhibited at the British Museum, and so much to admire about the present stunning economic progress. As for the problems such growth creates, they are huge, but at least the leadership is aware of them and will see it is in its own interest to tackle them.

China, we were told, is like a teenage boy who needs a lot of food to keep growing. I like the analogy. But teenage boys are inclined to be short on communication skills. Let's hope China gets easier to live with as it hits the next stage.

************

Hamish McRae: The greatest boom the world has ever seen

Published: 05 September 2007 | The Independent, London, UK

Beijing: China's pre-Olympics economic boom has ratcheted up a few clicks. With less than a year to run, it is not just the main stadium site that is humming; the entire city is a great building site. Not only is it rushing to complete new hotels and other facilities ahead of the games, it is also sprucing itself up: fixing pavements, repainting shopfronts, opening restaurants.

You can measure the China boom in the statistics – growth running at more than 11 per cent in the first half of this year – but nothing can prepare the visitor for the actuality. This is not just the greatest boom on earth at the moment – it is the greatest boom the world has ever known. In 2005, China passed the UK to become the world's fourth-largest economy; either this year or next, it will pass Germany to become the world's third largest. It is hard not to see it passing Japan to become the second largest within about a decade, and then it is at least plausible that within a generation it will pass the United States to become the biggest.

Most of us are vaguely aware of this, just as we are aware that, thanks largely to China, the world economy has, over the past five years, had its fastest growth ever recorded. We also can see, and this is more troubling, the pressure that this growth has put on world resources. We see it not just in the price of oil and minerals, but also of basic foodstuffs such as meats, wheat and maize.

Naturally, this is troubling China too: the main reason why inflation has shot up to more than 5 per cent is the rising cost of food, something that has its harshest impact on its urban poorest. The most extreme example I have found is the price of pork, which, partly as a result of an illness in pigs called blue ear that has cut supplies, is 75 per cent higher than a year ago.

We are also aware that there has been huge environmental degradation as a result of rapid industrialisation. Horror stories abound, including a million people losing their drinking water because of pollution from factories. Actually, the air in Beijing this week seems rather better than it was on my last visit a year ago, and much better than, say, Edinburgh in the 1950s. But the point was made forcibly to me this week at a meeting with top bankers, that China would clean up the environment because it had to for the health of its people. It would not pay any attention to what the West urged upon it. Incidentally, there is one big public health lesson we can learn from China: virtually the only obese people you see are tourists. China has so far avoided what is arguably the greatest single threat to health in the West.

There is a wider point here. China is industrialising on pretty much the same model as the various western economies did a century or more earlier, the key driver being a surge in manufactured exports. But there are three crucial differences. It is making the transformation much more swiftly. It affects vastly more people, some 20 per cent of humankind, than even the industrialisation of the United States. And it is happening at a time when many of the world's natural resources – from fish stocks to oil – are reaching limits of sustainability, and, in some cases, exceeding them.

Viewed rationally, this is not sustainable. That is accepted. One of our hosts pointed out that were China to reach Western levels of car ownership, they would use more fuel than the entire output of the world. But that has not stopped China building a motor industry that will become the world's largest within about five years, or pricing petrol at one-third of UK levels. China became a net importer of oil in the 1990s, and this year it is in the process of becoming a net importer of coal, too. But rather than be a pioneer in conservation, it has headed out into the world, doing deals – particularly with African countries – to try to secure supplies. This may give it some modest measure of greater security in the short-term, but oil is oil. There is a finite amount of the stuff, and such deals do little to increase the global supply.

Meanwhile, to price petrol so cheaply is nuts: poor farmers who need to buy it could be helped in other ways. "I agree," said a senior banker, "but I am not the government."

There is something else that is not sustainable. That is the trade imbalance between China and the US. You can hear the rumblings in Congress; the candidates in next year's presidential election will be forced to adopt a more protectionist stance. The modest and gradual revaluation of the yuan, forced on China by the US, has failed to cut the deficit; indeed, it seems to have had hardly any impact at all. So this problem will not go away.

The Chinese point out that their exports to the US are rising more slowly than their exports to Asia, which are rising by about 50 per cent a year. They point out that they have been responsible holders of US Treasury securities, in effect financing the trade gap. And, of course, it is Americans who buy the imports and, largely, American companies that help produce them, through licences and joint ventures. But these arguments won't play strong in Congress.

These coming months, the run-up to the Olympics will, I think, be crucial in the relations between China and the rest of the world. China is on display and will want to impress. Given the extraordinary achievements of the past 30 or so years, it will indeed dazzle the world. But it needs not just to dazzle but to build a harmonious relationship with its trading partners: to adopt a measured response commensurate with its power.

One of the most surprising aspects of being a Briton in China is periodic emergence of a curious victim mentality. We were reminded of Britain's role in selling opium to China. Er, yes, that was 150 years ago. Official tours of Shanghai, a wonderful city that was in some measure the creation of western businesses, remind people of the unequal treaties that gave western countries concessionary areas. Talk of the environmental cost of rapid industrialisation and you are told that this is really the responsibility of the Americans who buy their toys from Chinese factories.

It is all a bit odd. There is so much to admire about this ancient civilisation which, by the way, Londoners can catch a glimpse of when the terracotta warriors are exhibited at the British Museum, and so much to admire about the present stunning economic progress. As for the problems such growth creates, they are huge, but at least the leadership is aware of them and will see it is in its own interest to tackle them.

China, we were told, is like a teenage boy who needs a lot of food to keep growing. I like the analogy. But teenage boys are inclined to be short on communication skills. Let's hope China gets easier to live with as it hits the next stage.

Bill Miller's comments are a must read

http://seekingalpha.com/article/47056-bill-miller-on-timing-buys-in-housing-stocks

http://seekingalpha.com/article/47056-bill-miller-on-timing-buys-in-housing-stocks

OZ analyst says that the credit crisis could be just beginning

http://www.thestreet.com/pf/newsanalysis/investing/10380613.html

http://www.thestreet.com/pf/newsanalysis/investing/10380613.html

explod

explod

- Joined

- 4 March 2007

- Posts

- 7,341

- Reactions

- 1,197

OZ analyst says that the credit crisis could be just beginning

http://www.thestreet.com/pf/newsanalysis/investing/10380613.html

Well the article at face value would indicate that the recent credit crisis is just the beginning.

Low interest rates caused the problem of sub-prime in the first place, the drop of interest rates recently by the Fed would indicate that they do not really know what to do. Interesting times, hold your hats.

What has this to do with Support and Resistance ?

Ten Tips for a Tough Tape

http://www.minyanville.com/articles/GOOG-INTC-GS-MSFT-C-CSCO/index/a/16146

http://www.minyanville.com/articles/GOOG-INTC-GS-MSFT-C-CSCO/index/a/16146

tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,417

- Reactions

- 6,356

Hi Tech,

As no one else has had a go at analysing the top chart "if I own this stock would I sell it"

I'm a bit lost without my indicators but I'll give it a go:

Since the breakout, 9 bars ago - volume has been steadily falling away, this to me would be a sign of weakness - may indicate that interest in the stock is no longer there.

The second last bar shows indecision between bulls and bears ie open and close is in the middle of the range of the bar - no clear indication as to how is in charge - the bulls or the bears

The last bar went up on reduced volume - this was not because of bull power, but lack of selling pressure - again a meaningless bar

Prior to the breakout - we have an upsloping triangle - that being the case - the current price value is approx the target price

Also it looks like the end of a parabolic trend to me - gone verticle - unsustainable - violent retreat??

To my way of thinking - the probabilities of the price retreating are quite high - so at the very least I would tighten my stop.

However , the above is just what I see (or my mind is trained to see), the market has a habit of proving me wrong - as no doubt Tech will also.

Peter

As no one else has had a go at analysing the top chart "if I own this stock would I sell it"

I'm a bit lost without my indicators but I'll give it a go:

Since the breakout, 9 bars ago - volume has been steadily falling away, this to me would be a sign of weakness - may indicate that interest in the stock is no longer there.

The second last bar shows indecision between bulls and bears ie open and close is in the middle of the range of the bar - no clear indication as to how is in charge - the bulls or the bears

The last bar went up on reduced volume - this was not because of bull power, but lack of selling pressure - again a meaningless bar

Prior to the breakout - we have an upsloping triangle - that being the case - the current price value is approx the target price

Also it looks like the end of a parabolic trend to me - gone verticle - unsustainable - violent retreat??

To my way of thinking - the probabilities of the price retreating are quite high - so at the very least I would tighten my stop.

However , the above is just what I see (or my mind is trained to see), the market has a habit of proving me wrong - as no doubt Tech will also.

Peter

Similar threads

- Replies

- 11

- Views

- 2K

- Replies

- 31

- Views

- 4K

- Replies

- 96

- Views

- 8K