Actually if you get Keegan88's worksheet (page 1 of this thread) he gets exactly the same result as me (after you change his value in B26 from 34.99 to 35, since he's omitted the ROUND function.) He also uses RM's formula, so maybe we need RM on here to speak up for his work

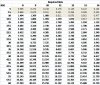

I went and downloaded the sheet so have the latest version B26 has his formulas within. Using the same numbers in both sheets current year RR 12 get $37.85 on yours and $30.92 on Keegan's. Please check numbers from the top on Keegan 12,10.19,2.62,1.021,5589.5.

Just to digress aquaity company such as BHP rates at worst RR 10% as the risk is lower, the quality is high.

Once again correct me if I have erred.