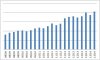

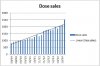

Looking at the chart above we may be going for fifth time lucky. Investing on quarterly sales can be dangerous, 4% growth the previous quarter compared to 18.7% in the most recent.

38 consecutive quarters of growth is nothing to sneeze at however.

Here is a view from a major shareholder predicting $100 per share.

http://www.youtube.com/watch?v=ry15oAg_1qw

38 consecutive quarters of growth is nothing to sneeze at however.

Here is a view from a major shareholder predicting $100 per share.

http://www.youtube.com/watch?v=ry15oAg_1qw