- Joined

- 14 December 2010

- Posts

- 3,472

- Reactions

- 248

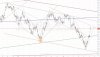

Price action on FTSE is much much cleaner though.

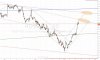

I find myself using limit orders on SPI more because setups are too wide and the stop can get taken out much easier IMO.

I find myself using limit orders on SPI more because setups are too wide and the stop can get taken out much easier IMO.