CanOz

Home runs feel good, but base hits pay bills!

- Joined

- 11 July 2006

- Posts

- 11,543

- Reactions

- 519

Yep IB has just the one contract. As they should its the same contract.

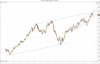

Ahh thats great TH thanks a bunch. I was having trouble getting a decent set of stats out of my system on the SPI, then i noticed how well it trended after hours so i started entering at the end of the day instead of the beginning...it quadrupled the returns...now to bring the win rate up a little....

Cheers,

CanOz