- Joined

- 30 May 2017

- Posts

- 2,513

- Reactions

- 4,140

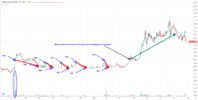

So looking at the stock dumping on the half year results announcement from our current portfolio stock Freelancer Ltd (FLN). Was there something concerning ? Should we be selling out and join in with the selling crowd ?

I actually saw the stock was down 15% during the day and easily could have chickened out and sold with the crowd. But I am slowly starting to put more faith in my research and move away from the herd mentality and stop what I used to do in my younger days and even at the start of this portfolio and that is to panic buy and panic sell.

I think when we come across stocks with the potential for decade long growth and when we find them early enough it's better to stick with it's longer term progress by at least holding a very small stake. I have many times come across great businesses in my analysis but have sold out due to declining price action or a short term hiccup in it's revenues losing the opportunity to stay on the business or to ever get back on at a later date.

So how can I still operate this rules based trading portfolio and still be able to have some shares in a company like FLN without being chopped up like a rodent in aminefield mousetrap field being whipsawed in and out of the portfolio over and over until all trading capital is gone and I have to close down this portfolio for good or till I keep working in the grave to build up some capital to speculate ?

Thankfully I had started a longer term portfolio Medium/Longer Term Stock Portfolio, where I can operate like the legendary share market legends like Peter Lynch and Warren Buffet. These guys are not perfect and they have made mistakes in their careers picking the wrong stocks but they have a longer term horizon to let the stocks with potential to realise it over time. There will be short term market gyrations and bumps along the road but they are not phased by that as they can see the inner workings of the company's progress.

Generally I am a sucker for picking up stocks in the earliest stages of it's lifespan but the great mentor Peter Lynch for example has made so many 10+ baggers picking up well known brands like Dell computer company, now called Dell Technologies Inc and L'eggs which sold woman's pantyhose back in the day and having being taken over still exist as a brand with multiple products making profits for the parent company:

He noticed and picked up Dell Computers when they were starting to appear in homes and businesses so by then it was a well known brand and his wife gave him the idea of looking into L'eggs when she talked about how easy and convenient it was to pick up a pair of woman's pantyhose at the supermarket with the weekly groceries or at the checkout at a convenience store without having to ever talk to a sales assistant back in the day when the company and it's sales were taking off...

I'll talk more about these investing legends and how we can apply some of their thinking to today's markets as we continue to look for opportunities in these portfolios over time.

So the plan is: if today's selloff in FLN turns into something bigger I will sell the stock out of this portfolio and realise a trading loss. However I will move the shares over to the longer term portfolio or keep a minimum holding for that portfolio. So in that case, the dog Freelancer Ltd (FLN) and it's flees Escrow.com and Freightlancer will all be moved over and kept without pressure to sell out in the short term until the company continues in it's current growth trajectory over the years or starts falling apart in which case I may lose faith and cut the loss.

Everyone is different and there are great traders out there who can trade in and out of a stock even if there are losses in the short term without losing hope or to get back in promptly if the price starts surging higher. Even though I keep watchlists, notes etc, I find it difficult to keep track once I am out of a stock and if the price starts surging on a stock that I want to be in I usually wait for a better entry and miss out altogether.

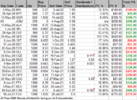

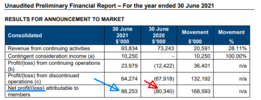

Let's look at today's numbers that was announced. The company made record revenues in all fronts and that is what attracted to me to this company in the first place. The company earns it's revenues in US$ however and as can be seen from the results, the AUD/USD currency headwinds dragged the results down, which is usually a short term effect as currencies move around...

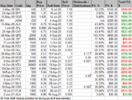

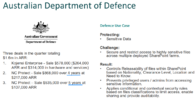

Escrow.com is a major contributing factor to the overall growth this company is experiencing:

It's got the hallmarks of an early stage disruptor like finding a PayPal, Ebay (owns gumtree) or AirBnB before they go mainstream in the media and all the funds, ETF's and mom and pop's want to buy into them for their blue chip income/retirement portfolio someday.

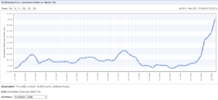

Just for comparison these two businesses combined has a market cap of about 1/60th the size of one of the biggest stories of asx Afterpay Ltd (APT) that is yet to make a profit. Talk to anyone in the investing/speculating circles and they'll be talking about it. I reckon each of the two main businesses in FLN is a leader in their own areas and Escrow.com is just leaping ahead, which is something to think about... And unlike Afterpay that's going for small margins on their small purchase retail customers, Escrow.com gets paid for big transactions involving when a jumbo jet or private jet is sold from one owner to another or that luxury car or the Rolex watch is sold from one owner to another. How about making a commission on every car sold on eBay USA ? Food for thoughts...

I actually saw the stock was down 15% during the day and easily could have chickened out and sold with the crowd. But I am slowly starting to put more faith in my research and move away from the herd mentality and stop what I used to do in my younger days and even at the start of this portfolio and that is to panic buy and panic sell.

I think when we come across stocks with the potential for decade long growth and when we find them early enough it's better to stick with it's longer term progress by at least holding a very small stake. I have many times come across great businesses in my analysis but have sold out due to declining price action or a short term hiccup in it's revenues losing the opportunity to stay on the business or to ever get back on at a later date.

So how can I still operate this rules based trading portfolio and still be able to have some shares in a company like FLN without being chopped up like a rodent in a

Thankfully I had started a longer term portfolio Medium/Longer Term Stock Portfolio, where I can operate like the legendary share market legends like Peter Lynch and Warren Buffet. These guys are not perfect and they have made mistakes in their careers picking the wrong stocks but they have a longer term horizon to let the stocks with potential to realise it over time. There will be short term market gyrations and bumps along the road but they are not phased by that as they can see the inner workings of the company's progress.

Generally I am a sucker for picking up stocks in the earliest stages of it's lifespan but the great mentor Peter Lynch for example has made so many 10+ baggers picking up well known brands like Dell computer company, now called Dell Technologies Inc and L'eggs which sold woman's pantyhose back in the day and having being taken over still exist as a brand with multiple products making profits for the parent company:

He noticed and picked up Dell Computers when they were starting to appear in homes and businesses so by then it was a well known brand and his wife gave him the idea of looking into L'eggs when she talked about how easy and convenient it was to pick up a pair of woman's pantyhose at the supermarket with the weekly groceries or at the checkout at a convenience store without having to ever talk to a sales assistant back in the day when the company and it's sales were taking off...

I'll talk more about these investing legends and how we can apply some of their thinking to today's markets as we continue to look for opportunities in these portfolios over time.

So the plan is: if today's selloff in FLN turns into something bigger I will sell the stock out of this portfolio and realise a trading loss. However I will move the shares over to the longer term portfolio or keep a minimum holding for that portfolio. So in that case, the dog Freelancer Ltd (FLN) and it's flees Escrow.com and Freightlancer will all be moved over and kept without pressure to sell out in the short term until the company continues in it's current growth trajectory over the years or starts falling apart in which case I may lose faith and cut the loss.

Everyone is different and there are great traders out there who can trade in and out of a stock even if there are losses in the short term without losing hope or to get back in promptly if the price starts surging higher. Even though I keep watchlists, notes etc, I find it difficult to keep track once I am out of a stock and if the price starts surging on a stock that I want to be in I usually wait for a better entry and miss out altogether.

Let's look at today's numbers that was announced. The company made record revenues in all fronts and that is what attracted to me to this company in the first place. The company earns it's revenues in US$ however and as can be seen from the results, the AUD/USD currency headwinds dragged the results down, which is usually a short term effect as currencies move around...

Escrow.com is a major contributing factor to the overall growth this company is experiencing:

It's got the hallmarks of an early stage disruptor like finding a PayPal, Ebay (owns gumtree) or AirBnB before they go mainstream in the media and all the funds, ETF's and mom and pop's want to buy into them for their blue chip income/retirement portfolio someday.

Just for comparison these two businesses combined has a market cap of about 1/60th the size of one of the biggest stories of asx Afterpay Ltd (APT) that is yet to make a profit. Talk to anyone in the investing/speculating circles and they'll be talking about it. I reckon each of the two main businesses in FLN is a leader in their own areas and Escrow.com is just leaping ahead, which is something to think about... And unlike Afterpay that's going for small margins on their small purchase retail customers, Escrow.com gets paid for big transactions involving when a jumbo jet or private jet is sold from one owner to another or that luxury car or the Rolex watch is sold from one owner to another. How about making a commission on every car sold on eBay USA ? Food for thoughts...