- Joined

- 30 May 2017

- Posts

- 2,513

- Reactions

- 4,140

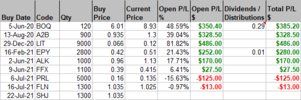

Probably not benchmarking, but I do monitor the stocks in the portfolio and how they are performing.You benchmarking yourself against anything @aus_trader ?

The reduction of office space in the inner city is not the trend currently emerging. While there is considerable differences between companies and certainly a difference between private companies and government tenants .. the general trend is for similar sized office space.I think employees and bosses have seen the win-win scenario that it has created. Workers are able to save time and fuel travelling to work which could be in a city center far from home. They can also be close to family and be with them as soon as you clock off from work. Bosses are able to save money by downsizing office space which tend to be quite expensive wherever it's located especially if it's in a city tower. So instead of having 5 floors of a city tower to run the company, now it could do it by occupying just 1 floor level. So overall time and money saved, productivity up (KPI's at highest levels) and improved health and wellbeing due to lower stress levels stuck in peak hour congestion or crowded in public transport, which works a treat if the virus is around.

WFH is not really new, i was WFH while consulting 15y ago ..The reduction of office space in the inner city is not the trend currently emerging. While there is considerable differences between companies and certainly a difference between private companies and government tenants .. the general trend is for similar sized office space.

Currently the most common model appears to be for a hybrid of X days working from home and Y days working from the office (2 home / 3 office or 1 home / 4 office are common themes). The designs being developed are allowing for lower peak people numbers but with greater space between workstations.

The above is only for Sydney inner city office space, based on the design briefs currently being put to Architectural firms and being submitted for DA approval. Although 3rd party reports out of Melbourne are telling a similar story.

I don't think the final model has been settled for either employees or companies and it will take a while yet.

Yes I've also seen part work from home / part come into the office scenarios for some office workers but the same level of full time occupancy and cubicle density will be unlikely to continue. I believe the tide has turned for good outsourcing is going full scale which is great for companies like FLN.The reduction of office space in the inner city is not the trend currently emerging. While there is considerable differences between companies and certainly a difference between private companies and government tenants .. the general trend is for similar sized office space.

Currently the most common model appears to be for a hybrid of X days working from home and Y days working from the office (2 home / 3 office or 1 home / 4 office are common themes). The designs being developed are allowing for lower peak people numbers but with greater space between workstations.

The above is only for Sydney inner city office space, based on the design briefs currently being put to Architectural firms and being submitted for DA approval. Although 3rd party reports out of Melbourne are telling a similar story.

I don't think the final model has been settled for either employees or companies and it will take a while yet.

Sadly for the west, no difference between someone designing in bali mumbai or Sydney, so loss for Oz mid termYes I've also seen part work from home / part come into the office scenarios for some office workers but the same level of full time occupancy and cubicle density will be unlikely to continue. I believe the tide has turned for good outsourcing is going full scale which is great for companies like FLN.

So just to clarify when I say outsourcing is going full scale I am not talking about putting a call center in India or Malaysia and run the rest of the operations from the CBD head office. I am talking a lot of the work itself such as design, customer support, advertising, web design/maintenance (Used to be done by the IT department), back office functions such as record keeping, backing up etc being outsourced. I think @qldfrog sees the same transformation that is taking place.

Very true @qldfrog, it's sad that we will not have all the jobs to ourselves at any cost to companies in order to hire us !Sadly for the west, no difference between someone designing in bali mumbai or Sydney, so loss for Oz mid term

Sure, but this has profund effects as we have basically priced ourselves out of every value added job, and with automatisation, there is not much leftno manufacturing, no office admin, retail, barista and taxi truck machinery drivers for a short timeVery true @qldfrog, it's sad that we will not have all the jobs to ourselves at any cost to companies in order to hire us !

However there is no turning back. I have seen this type of scenario play out in front of my own eyes in the manufacturing sector in Australia where I thought I had a 40-year career for life in Automotive manufacturing. We know what happened to that sector.

So this time it's the transformation of administrative/office jobs. Any job that could be done remotely will have to compete with the Global workforce as companies like FLN start offering the skilled talents of freelancers from around the globe to compete for the same job.

It's a slow process as successful companies adapt and change and as rigid headstrong firms get priced out and disappear over time, but I think it's good to be aware of these global shifts taking place. I had tunnel vision back in the manufacturing days and even as the slow shift was happening all around me, that caused all Automotive manufacturing in Australia to move to overseas I decided to bury my head under the sand until being laid off one day. Could have re-trained or moved to another sector if I kept my eyes open

There will be completely different jobs that will arise due to the shift taking place however.Sure, but this has profund effects as we have basically priced ourselves out of every value added job, and with automatisation, there is not much leftno manufacturing, no office admin, retail, barista and taxi truck machinery drivers for a short time

But they can all be done os for cheaperThere will be completely different jobs that will arise due to the shift taking place however.

Things like automation engineering, robotics, design, CAD, photoshop, video editing, making movies/documentaries and a whole lot of other creative jobs cannot be replaced by automation or computers IMO.

That's the scary part mate...But they can all be done os for cheaper

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.