- Joined

- 30 May 2017

- Posts

- 2,513

- Reactions

- 4,140

It's bee a long time since I bought any speculative stocks. And looking back I think that was a good move since any positions would have been held only for a short time as the market continued down.

Still cautious about overall market but I decided to buy back Zip Co Ltd(Z1P) that I have had in this portfolio before. It's having some price move from consolidating for a while which is similar to what is seen on the bigger multi-billion dollar rival Afterpay Touch Group Ltd (APT).

PS: I have also changed Qty for the CSS shares to allow for the share split/consolidation that took place recently.

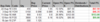

Open Portfolio:

Still cautious about overall market but I decided to buy back Zip Co Ltd(Z1P) that I have had in this portfolio before. It's having some price move from consolidating for a while which is similar to what is seen on the bigger multi-billion dollar rival Afterpay Touch Group Ltd (APT).

PS: I have also changed Qty for the CSS shares to allow for the share split/consolidation that took place recently.

Open Portfolio: