skc

Goldmember

- Joined

- 12 August 2008

- Posts

- 8,277

- Reactions

- 329

End of Week 41 Summary

Portfolio value up 15.3%

XJO -13.55% (Last 4101.9, Starting value 4745)

XJOAI -8.52% (Last 31686, Starting value 34639.1)

Commentary

As savage as today's sell off is, the market is only down ~70pts for the week. Europe is on the ropes and plenty of contagion fear (and risks) in the banking system of both Europe and US. It's not just the risk of writedowns on PIIGS debts on the banks balance sheet that is the concern. The unregulated CDS on these debt are the new disease that will freeze the banking system yet again.

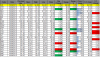

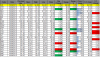

Australia should outperform both US and EU over the next 3 months, but that's no reason to start buying shares just yet. The 2 conditions I've outlined last week have both failed. DJIA registered another 400pt+ move last night, and strong corporate results are not being followed through. Here are a table to illustrate the point.

Quite a few decent results from yesterday (IDL, MIN, WES, ASZ) and their share price managed to close near the top of the range, but today the market smack them back down without hesitation. I don't think it's time to dive back in just yet for this portfolio.

Portfolio value up 15.3%

XJO -13.55% (Last 4101.9, Starting value 4745)

XJOAI -8.52% (Last 31686, Starting value 34639.1)

Commentary

As savage as today's sell off is, the market is only down ~70pts for the week. Europe is on the ropes and plenty of contagion fear (and risks) in the banking system of both Europe and US. It's not just the risk of writedowns on PIIGS debts on the banks balance sheet that is the concern. The unregulated CDS on these debt are the new disease that will freeze the banking system yet again.

Australia should outperform both US and EU over the next 3 months, but that's no reason to start buying shares just yet. The 2 conditions I've outlined last week have both failed. DJIA registered another 400pt+ move last night, and strong corporate results are not being followed through. Here are a table to illustrate the point.

Quite a few decent results from yesterday (IDL, MIN, WES, ASZ) and their share price managed to close near the top of the range, but today the market smack them back down without hesitation. I don't think it's time to dive back in just yet for this portfolio.