CanOz

Home runs feel good, but base hits pay bills!

- Joined

- 11 July 2006

- Posts

- 11,543

- Reactions

- 519

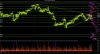

Here is an hourly view of the SI contract. After the failure of 32.5 we've had failures of 32.0 as well. That said, there is a value area between 32.28 and 31.57 forming, so price is being accepted in this area. I think we'd need to see a break of 32.28 and a retest for continuation. That could provide a lower risk entry into Silver. If that was successful then we could see a test of 32.73, 33.46, 33.86 and 34.43. These Low Volume Nodes (LVNs) could provide some resistance on the way up, but could be potential entry points for continuation if they test successfully and value is established higher.

Of course, there is a downside as well and a break of 31.0 could see this play out.

Cheers,

CanOz

Of course, there is a downside as well and a break of 31.0 could see this play out.

Cheers,

CanOz