- Joined

- 3 July 2009

- Posts

- 27,087

- Reactions

- 23,681

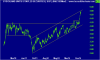

Hitting an interday high of $4.27 SGP is only a hairs breadth away from breaking through the resistance level of $4.28.

View attachment 60856

SGP is still out of sync with the likes of GPT. It remains to be seen as to whether SGP can push higher or fades in the new year after it goes ex-div on 29/12/14. As always do your own research and good luck.

Can't get excited about a company, that relies on shopping centres and real estate, in the current climate.