- Joined

- 14 June 2007

- Posts

- 1,130

- Reactions

- 3

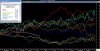

So I figure there should be a thread for sector analysis. To kick it off here is a chart comparing the GICS sectors to the XJO. Healthcare (XHJ) is outperforming very steadily and after running though the XHJ constituents I pick Ansell as one to watch. (I won't add how I would approach it as everyone has a different trading style and will approach situations very differently.) Have included monthly and daily charts.

(but I'm a glass half full kind of guy and it looks promising to me). Only time will tell.

(but I'm a glass half full kind of guy and it looks promising to me). Only time will tell.