- Joined

- 19 May 2010

- Posts

- 293

- Reactions

- 1

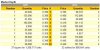

I'm a big fan of their strategy to secure low cost acres then shore them up then onsell them, keeping a slice of equity for the company and sometimes a royalty, kind of like the Cape Lambert of the Eagle Ford Shale  . According to my calculations (somewhat conservative) SEA is currently worth about 50 cents per share, which is similar to the result that Euroz (48 cents, but it's pre-twister sale) got in their report a while back (having dug it up after I calculated mine, it gave me confidence to buy in this morning expecting a small dip before rising, but instead it just skipped to the rising part

. According to my calculations (somewhat conservative) SEA is currently worth about 50 cents per share, which is similar to the result that Euroz (48 cents, but it's pre-twister sale) got in their report a while back (having dug it up after I calculated mine, it gave me confidence to buy in this morning expecting a small dip before rising, but instead it just skipped to the rising part  ). I'm hoping it'll be onwards and upwards from here on!

). I'm hoping it'll be onwards and upwards from here on!