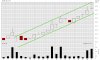

Apparantly Euroz Securities have upgraded SEA toa buy with a 20c target...i cannot confirm the accuracey of this , its from HC on 12feb 2010

But i can say on my calcs thats probably a conservative target.....

Definitely DYOR and seek advice this is a small oiler & is high risk IMO, but likely high reward if things continue as they have been lately...

But i can say on my calcs thats probably a conservative target.....

Definitely DYOR and seek advice this is a small oiler & is high risk IMO, but likely high reward if things continue as they have been lately...