You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

SDV - SciDev Limited

- Thread starter Meso1973

- Start date

- Joined

- 24 December 2006

- Posts

- 264

- Reactions

- 1

Whats everyones thoughts on this company? Where is it headed? PS i really hate how you have to use a certain amount of letters before you can post

Intersting to see how INL held up today with the last 2 days of turmoil oao the Dow and fears of the subprimes. At close INL was up 1c (0.155 0.160 0.160 0.010 6.67 0.155 0.160 0.150 1,376,121) when most of my board was red. 1.3 mil is a reasonable vol, so could be interesting few months ahead for this little zincie (I hold)

Nice little B/O above 16c today for this share, although not may buying above 15c. Buyers still need confidence in this stock to start getting back in and probably won't come until it breaks 20c.

Hi I hold INL shares.

I hold a large amount in this company and do believe that this share should reach a much higher level, the company is run by tight consevatives that are reluctant to talk stock up, the next few months we should see a foward mooooove. Good Luck everyone.:

Hi I hold INL shares.

I hold a large amount in this company and do believe that this share should reach a much higher level,

Why? because you own a large amount?

the company is run by tight consevatives that are reluctant to talk stock up,

This is a actually a positive thing

Again why? Without any evidence to back up your claims you are quite simply ramping.the next few months we should see a foward mooooove.

Qtly is due tomorrow, or should be!

Some questions:

Why did PW take a directorship with CMR Compass Resources ( he doesn't need any more work, or a job? )

Who has been buying lot's of inl lately?

Would inl be of any use to CMR. possibley.

What of OUTOTEC's involvement with Braemore Resources Leinster nickel sulphide tailings project in WA. To which BHP has a supply agrement.

If there is such a thing as chemistry, then maybee something is brewing

If nothing else i feel the directors of inl can keep their mouths shut

Some questions:

Why did PW take a directorship with CMR Compass Resources ( he doesn't need any more work, or a job? )

Who has been buying lot's of inl lately?

Would inl be of any use to CMR. possibley.

What of OUTOTEC's involvement with Braemore Resources Leinster nickel sulphide tailings project in WA. To which BHP has a supply agrement.

If there is such a thing as chemistry, then maybee something is brewing

If nothing else i feel the directors of inl can keep their mouths shut

I think you will be disappointed tomorrow as INL usually releases the report on the last day of the last week but after the ASX closes. It will give everyone a night to digest the contents and so on Wednesday it should be on for young and old.

Tomorrow INL will more than likely get to 17 cents as people take their position but Wednesday will be a whole new ball game.

I hope I am wrong about the release timing but I doubt it.

The good thing about the Company is that it does not ramp. So read with confidence what is said as it will be conservative.

Tomorrow INL will more than likely get to 17 cents as people take their position but Wednesday will be a whole new ball game.

I hope I am wrong about the release timing but I doubt it.

The good thing about the Company is that it does not ramp. So read with confidence what is said as it will be conservative.

Qtly is due tomorrow, or should be!

Some questions:

Why did PW take a directorship with CMR Compass Resources ( he doesn't need any more work, or a job? )

Who has been buying lot's of inl lately?

Would inl be of any use to CMR. possibley.

What of OUTOTEC's involvement with Braemore Resources Leinster nickel sulphide tailings project in WA. To which BHP has a supply agrement.

If there is such a thing as chemistry, then maybee something is brewing

If nothing else i feel the directors of inl can keep their mouths shut

Juiceman - what do you know on CMR, it appears to be expensive at $5 and not yet earning $$$. Having said that it's holding it's price and investors are seeing value. Interested in your opinion. Regards RFG

- Joined

- 24 December 2006

- Posts

- 264

- Reactions

- 1

Ann out 31 July 2007 Smorgon and Intec Sign Stage 2 EAF Dust Agreement

Smorgon Steel Group Ltd (ASX code: SSX) and Intec Ltd (ASX code: INL) yesterday entered into the Stage 2 EAF Dust Supply and Treatment agreement for the ongoing supply by SSX over a (minimum and renewable) three year period of electric arc furnace dust (EAF Dust) as feedstock for

INL’s Hellyer Residues Project (HRP) in northwestern Tasmania. The HRP is expected to commence commercial production in early 2009.

This Stage 2 Agreement builds upon the Stage 1 EAF Dust Stockpile Transfer and Treatment Agreement between SSX and INL dated 21 February 2006 in relation to the 20,500 tonnes EAF Dust stockpile in West Footscray, Melbourne (also to be treated via the HRP). It also follows the successful extraction during 2006 at INL’s demonstration plant in Burnie, Tasmania of effectively all of the contained zinc, lead and silver from SSX’s ‘arising’, and INL’s stockpiled, EAF Dust.

The state regulatory authorities in Victoria and Tasmania have given the relevant approvals for the interim storage of the EAF Dust under the Stage 2 Agreement and for the renewed operation of the Burnie plant on a feedstock primarily consisting of EAF Dust, which is expected to commence on a campaign basis late in the current quarter, in order to provide detailed operational and engineering data for the HRP.

(etc)

Smorgon Steel Group Ltd (ASX code: SSX) and Intec Ltd (ASX code: INL) yesterday entered into the Stage 2 EAF Dust Supply and Treatment agreement for the ongoing supply by SSX over a (minimum and renewable) three year period of electric arc furnace dust (EAF Dust) as feedstock for

INL’s Hellyer Residues Project (HRP) in northwestern Tasmania. The HRP is expected to commence commercial production in early 2009.

This Stage 2 Agreement builds upon the Stage 1 EAF Dust Stockpile Transfer and Treatment Agreement between SSX and INL dated 21 February 2006 in relation to the 20,500 tonnes EAF Dust stockpile in West Footscray, Melbourne (also to be treated via the HRP). It also follows the successful extraction during 2006 at INL’s demonstration plant in Burnie, Tasmania of effectively all of the contained zinc, lead and silver from SSX’s ‘arising’, and INL’s stockpiled, EAF Dust.

The state regulatory authorities in Victoria and Tasmania have given the relevant approvals for the interim storage of the EAF Dust under the Stage 2 Agreement and for the renewed operation of the Burnie plant on a feedstock primarily consisting of EAF Dust, which is expected to commence on a campaign basis late in the current quarter, in order to provide detailed operational and engineering data for the HRP.

(etc)

Not a bad read

I do believe that in the future the market will be valueing their equipment, not just weighing it ha ha and all is on track.

I do know that there were 2 x 5000t shipments that left Burnie in the last 10 days of June, that were not counted in that qrtrs accounts.

I do believe that in the future the market will be valueing their equipment, not just weighing it ha ha and all is on track.

I do know that there were 2 x 5000t shipments that left Burnie in the last 10 days of June, that were not counted in that qrtrs accounts.

Porper

Ralph Nelson Elliott

- Joined

- 11 August 2004

- Posts

- 1,413

- Reactions

- 274

Not a bad read

I do believe that in the future the market will be valueing their equipment, not just weighing it ha ha and all is on track.

I do know that there were 2 x 5000t shipments that left Burnie in the last 10 days of July, that were not counted in that qrtrs accounts.

Doesn't seem to be much we already didn't know to me.

Everything is still on track , but it seems a long slow climb, with a few ifs and buts in the way..Short term I can't see any reason for the share price to rise significantly, I have some for my retirement in 25 years time

- Joined

- 24 December 2006

- Posts

- 264

- Reactions

- 1

INL qrtly out after 5pm

Havn't read it yet, so will comment later. Pig's really do fly (sometimes)

Hmm, quitely optimistic. I see IVN is still major shareholder, sitting at no 2 with +34 mil shares, but for now it seems to be happy just to sit on the sidelines even though Rio has ordered it to divest non-core assests.

From page 1 Highlights

• The Hellyer Zinc Concentrate Project Joint Venture (50/50 Intec/Polymetals) has experienced its first full quarter of steady production, totalling 13,763 tonnes of bulk zinc concentrate grading 38% Zn, 10% Pb and 144g/t Ag and is now reliably and substantially cash-flow positive.

• In view of this year’s escalating lead price, Intec and Polymetals are implementing inexpensive options to speedily and substantially increase the overall lead recoveries from the tailings feedstock.

• Bass Metals Ltd has commenced mining at Que River and will be processing its ore through the nearby Rosebery Mill owned by Zinifex Limited. The market value of Intec’s 23.2% shareholding in Bass Metals rose during the June quarter to A$7.7 million.

• Progress of Intec’s Hellyer Residues Project remains on-track for construction in 2008 and operation in 2009. This is to be achieved via reconfiguration and then recommencement of operations at the Burnie Demonstration Plant, followed by staged development to ensure the earliest possible production at the lowest capital and operating cost.

• The cornerstone supplier of feedstock to the Hellyer Residues Project will be Smorgon Steel, with which Intec yesterday signed a long-term (three-year minimum and renewable) contract to recycle and recover the substantial contained zinc, lead and silver values of its entire annual production of EAF dust from both of its Australian operations. This contract secures 15,000tpa of high-grade EAF dust, containing 30-40% Zn, 1-2% Pb and ~100g/t Ag, with a total contained metal value of approximately A$20 million per annum at current metal prices.

• The Ammtec-WorleyParsons report has now been received by Intec, updating the 2004 pre-feasibility study by H.G. Engineering (since merged with WorleyParsons) for the now-superseded Intec Hellyer Metals Project. This provides useful generic information concerning the Intec Process and for future stages of development at Hellyer and elsewhere, but is not on the critical path for the current active development of the Hellyer Residues Project.

• Broker coverage by Macquarie Securities (Australia) Limited commenced in July. Meanwhile, the top 20 Intec shareholders continue to accumulate on a net basis.

• The total cash available at the end of the quarter was A$2,971,000.

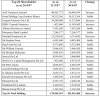

Attachments

Tell me of any company with no short term debt and no long term debt; that is cash-flow positive; that has almost $3 million in cash and is waiting for payment of two shipments of concentrate; that has a proven resource worth billions, yes not millions, of dollars; mining and processing costs (from memory ) is about $10 a tonne; has substantial high quality back-up material and the means to process it; has concentrate sale contracts into the future years; and is ploughing ahead with planning new facilities to add value to what it has.

The "any" company is Intec.

And what is its share price?

16.5 cents. You have to be joking.

The "any" company is Intec.

And what is its share price?

16.5 cents. You have to be joking.

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,268

- Reactions

- 11,514

Need to be thinking market cap Mango and compare to inground value, eps etc, not just the sp. But I think when you do that you will still find this looks cheap for whatever reason. The analysis has been done back in the thread. Some of the other posters here have amuch better handle on it's 'value'. I just follow the chart for the moment.Tell me of any company with no short term debt and no long term debt; that is cash-flow positive; that has almost $3 million in cash and is waiting for payment of two shipments of concentrate; that has a proven resource worth billions, yes not millions, of dollars; mining and processing costs (from memory ) is about $10 a tonne; has substantial high quality back-up material and the means to process it; has concentrate sale contracts into the future years; and is ploughing ahead with planning new facilities to add value to what it has.

The "any" company is Intec.

And what is its share price?

16.5 cents. You have to be joking.

Need to be thinking market cap Mango and compare to inground value, eps etc, not just the sp. But I think when you do that you will still find this looks cheap for whatever reason. The analysis has been done back in the thread. Some of the other posters here have amuch better handle on it's 'value'. I just follow the chart for the moment.

Have looked at the analysis kennas and as you say "you will still find this looks cheap for whatever reason." As a chartist INL does not look healthy; as a fundamentalist it does look healthy.

Give the charts a few good weeks and watch the result.

It is getting the few good weeks for the charts that is the problem.

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,268

- Reactions

- 11,514

I did all the fundy stuff on this in mid 06 and then waited for the breakout which occurred in Oct 06, and then bailed when it broke down in Jan. Tried to pick up a couple of turn arounds but it kept on failing. I've saved a ton by getting out at the right time and the money has gone to more tastey fish. Good luck to the long holding. Chartwise now, .175 needs to be broken clearly before I'm interested and then if it finds 20 cents again, I'd consider it. Meanwhile, sideways.....all the best.Have looked at the analysis kennas and as you say "you will still find this looks cheap for whatever reason." As a chartist INL does not look healthy; as a fundamentalist it does look healthy.

Give the charts a few good weeks and watch the result.

It is getting the few good weeks for the charts that is the problem.

I did all the fundy stuff on this in mid 06 and then waited for the breakout which occurred in Oct 06, and then bailed when it broke down in Jan. Tried to pick up a couple of turn arounds but it kept on failing. I've saved a ton by getting out at the right time and the money has gone to more tastey fish. Good luck to the long holding. Chartwise now, .175 needs to be broken clearly before I'm interested and then if it finds 20 cents again, I'd consider it. Meanwhile, sideways.....all the best.

Well kennas we will just have to wait and see what happens. Certainly 17.5 and then 20 cents will have to go.

As I've said elsewhere it is now only sentiment that is holding it back.

Well kennas we will just have to wait and see what happens. Certainly 17.5 and then 20 cents will have to go.

As I've said elsewhere it is now only sentiment that is holding it back.

Some news on zinc from Platts.

Hope Macquarie change their tune on the future price of zinc soon.

As for the rest of the complex, nickel saw another small drop to be bid at $30,553/mt, down $847 from Tuesday's close, while stocks stood at 14,412 mt, up 432 mt in just one day. "The metal we continue to favour is zinc," said Adams, "with LME stocks now at a fresh 16 year low, we feel it is only a question of time before the market wakes up to the situation." Zinc was bid at $3,454/mt, down $91 from Tuesday's close, while stocks stood at 66,225 mt on Wednesday, up 350 mt from the previous day. Lead was bid at $3,052/mt, down $53 from the previous close, while tin was bid at $15,750/mt, down $450 from Tuesday's close. "We would expect scale-down buying to turn the market higher on Wednesday," concluded Adams, "especially as the commodities continue to provide an alternative investment."

This commentary was first published in Platts Metals Alert. If you have any feedback about this commentary or want to find out more about Platts Metals products and services, please contact webeditor@platts.com.

Updated: Aug 1, 2007