You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Scalping FX with Cyrox Rainbow

- Thread starter tayser

- Start date

prawn_86

Mod: Call me Dendrobranchiata

- Joined

- 23 May 2007

- Posts

- 6,637

- Reactions

- 7

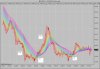

Man did i just learn a HUUUGE lesson  Luckily it wasnt costly

Luckily it wasnt costly

1st: Standard trade. Entered on the break of 152 and that was my mental stop at first.

2nd: Entered when spine turned down along with yellows slowly expanding. Exit is where the mistake happened. I had a take profit of 25 pips set, i didnt realise it had executed.... I pressed 'buy' to close out what i thought was a short, but it opened a new long.

3rd: Exit got stopped out straight away at - 10 pips.

Lesson = Know what your take profits are set at!!!!

Still a nice 34 pips for the day, but should have been 44.

1st: Standard trade. Entered on the break of 152 and that was my mental stop at first.

2nd: Entered when spine turned down along with yellows slowly expanding. Exit is where the mistake happened. I had a take profit of 25 pips set, i didnt realise it had executed.... I pressed 'buy' to close out what i thought was a short, but it opened a new long.

3rd: Exit got stopped out straight away at - 10 pips.

Lesson = Know what your take profits are set at!!!!

Still a nice 34 pips for the day, but should have been 44.

Attachments

prawn_86

Mod: Call me Dendrobranchiata

- Joined

- 23 May 2007

- Posts

- 6,637

- Reactions

- 7

First live losing session. Kept entering too late so that the spread didnt get covered quick enough. Oanda is also about 3pips out from Gain this morning.

1: Good Entry, bad exit. Dont really know what i was thinking

2: Had to hold a long time just for a couple pips

3: Quick pips. Followed my rules

4: Got greedy and then faked out. Very bad trade.

5: Got slipped a little, but it still didnt move as much as i was hoping. Should have prob closed for a small profit.

6: Another late entry.

Now i'll regroup and wait for FF open.

1: Good Entry, bad exit. Dont really know what i was thinking

2: Had to hold a long time just for a couple pips

3: Quick pips. Followed my rules

4: Got greedy and then faked out. Very bad trade.

5: Got slipped a little, but it still didnt move as much as i was hoping. Should have prob closed for a small profit.

6: Another late entry.

Now i'll regroup and wait for FF open.

Attachments

prawn_86

Mod: Call me Dendrobranchiata

- Joined

- 23 May 2007

- Posts

- 6,637

- Reactions

- 7

Bit of a mixed bag. Made some, gave it back, then made some more...

Should have quit after my first trade for the session. I had more than my target. Lesson learnt...

1: Perfect entry. Spine just crossed over etc. very happy with.

2: Was looking for break up. In hindsight it had probably already moved too quick. need to identify this earlier and exit for small loss.

3: A couple pips profit turned into a big loss. Once again need to identify exit earlier.

4: Better exit. I was wary of the 150 level. (in fact its still hovering around that)

5: Looking for break of 150. Exited as soon as it stalled.

I seem to be able to exit my profitable trades well, on stalling or breakdown of teeth, but struggle with exits for my losses at this stage.

Any ideas?

EDIT - The spread on the EJ is about 2.5 pips so the losses include them.

Should have quit after my first trade for the session. I had more than my target. Lesson learnt...

1: Perfect entry. Spine just crossed over etc. very happy with.

2: Was looking for break up. In hindsight it had probably already moved too quick. need to identify this earlier and exit for small loss.

3: A couple pips profit turned into a big loss. Once again need to identify exit earlier.

4: Better exit. I was wary of the 150 level. (in fact its still hovering around that)

5: Looking for break of 150. Exited as soon as it stalled.

I seem to be able to exit my profitable trades well, on stalling or breakdown of teeth, but struggle with exits for my losses at this stage.

Any ideas?

EDIT - The spread on the EJ is about 2.5 pips so the losses include them.

Attachments

prawn_86

Mod: Call me Dendrobranchiata

- Joined

- 23 May 2007

- Posts

- 6,637

- Reactions

- 7

That me done for the week. Returned over 7% of initial acc for my first week live.

Full stats can be found at my blog:

https://www.aussiestockforums.com/forums/blog.php?u=8739

Any help/advice/opinions appreciated

Full stats can be found at my blog:

https://www.aussiestockforums.com/forums/blog.php?u=8739

Any help/advice/opinions appreciated

Well done Prawny mah boy! soon you'll be able to buy the indicators

_____________

Silly 1st & 2nd trade, (the second was completely against all the rules - yellow spine going in opposite direction) - happens when you first load up your charts and you see the market's bearing its breasts...

_____________

Silly 1st & 2nd trade, (the second was completely against all the rules - yellow spine going in opposite direction) - happens when you first load up your charts and you see the market's bearing its breasts...

- Joined

- 29 May 2008

- Posts

- 677

- Reactions

- 0

Hey tayser, is there a template for that set up you are using for ninja trader?

i actually prefer it to the one that Prawn is using (its just easier on the eyes, no offence : )

: )

also are you able to give a quick run down on those indicators you are using at the bottom of the screen, or provide a link?

and yes, nice return this week prawner. i'm pretty impressed

i actually prefer it to the one that Prawn is using (its just easier on the eyes, no offence

also are you able to give a quick run down on those indicators you are using at the bottom of the screen, or provide a link?

and yes, nice return this week prawner. i'm pretty impressed

I'm using the official setup - you need to pay for a license ($600USD) to use it. www.cyrox.com

You dont actually need the indicators (as Prawn is illustrating in this very thread!) - CyroxOsc is just telling you up/down (green/red), CyrinusTrend is just another representation of the rainbow (it's more about the transition between colours rather than the colours themselves) and CamillaTrend has the same colours/transitions as CyrinusTrend but it looks at longer timeframes.

Prawn's using the setup that I put together based on the WMAs Trollmann uses.

You dont actually need the indicators (as Prawn is illustrating in this very thread!) - CyroxOsc is just telling you up/down (green/red), CyrinusTrend is just another representation of the rainbow (it's more about the transition between colours rather than the colours themselves) and CamillaTrend has the same colours/transitions as CyrinusTrend but it looks at longer timeframes.

Prawn's using the setup that I put together based on the WMAs Trollmann uses.

- Joined

- 29 May 2008

- Posts

- 677

- Reactions

- 0

I'm using the official setup - you need to pay for a license ($600USD) to use it. www.cyrox.com

You dont actually need the indicators (as Prawn is illustrating in this very thread!) - CyroxOsc is just telling you up/down (green/red), CyrinusTrend is just another representation of the rainbow (it's more about the transition between colours rather than the colours themselves) and CamillaTrend has the same colours/transitions as CyrinusTrend but it looks at longer timeframes.

Prawn's using the setup that I put together based on the WMAs Trollmann uses.

ahh right, thanks

is there anywhere that i can read up on the entry and exit rules so i can follow what you guys are acting on?

prawn_86

Mod: Call me Dendrobranchiata

- Joined

- 23 May 2007

- Posts

- 6,637

- Reactions

- 7

prawn_86

Mod: Call me Dendrobranchiata

- Joined

- 23 May 2007

- Posts

- 6,637

- Reactions

- 7

Definitely overtraded this morning.

Finished up 7 pips down unfortunately.

Once again need to cut back on stupid trades. Hold winners longer, cut losers short.

Easy to say, harder to do...

Finished up 7 pips down unfortunately.

Once again need to cut back on stupid trades. Hold winners longer, cut losers short.

Easy to say, harder to do...

Attachments

prawn_86

Mod: Call me Dendrobranchiata

- Joined

- 23 May 2007

- Posts

- 6,637

- Reactions

- 7

prawn_86

Mod: Call me Dendrobranchiata

- Joined

- 23 May 2007

- Posts

- 6,637

- Reactions

- 7

prawn_86

Mod: Call me Dendrobranchiata

- Joined

- 23 May 2007

- Posts

- 6,637

- Reactions

- 7

Trembling Hand

Can be found on the bid

- Joined

- 10 June 2007

- Posts

- 8,852

- Reactions

- 205

I really need to cut my losers quicker.

Any ideas how to do this in such a fast market?

A big problem with trading often (scalping) is getting over the spread.

That's why I hate hitting the market for an entry. If you do the sums you see why it hurts so much. Lets say 10 trades a day X 200 days per year X 2 point spread = 4000 pips!!

That's why your loses are hurting. They are 2 pips bigger than they should be IMHO. And your winners at least 2 pips, I would say 4, less than they should be.

Similar threads

- Replies

- 3

- Views

- 862

- Poll

- Replies

- 258

- Views

- 20K