Trembling Hand

Can be found on the bid

- Joined

- 10 June 2007

- Posts

- 8,852

- Reactions

- 205

Prawn I find it useful to look at last low ticks as adjustment levels for my exit when long and last high ticks when short.

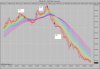

You can still be very aggressive with the exits but don't look at the current price rather at the last lows(for long trades). I find this very helpful because when you are going for small targets it is all to easy to bail out to soon. So in my mind when a trade goes my way by say 4 ticks then I am thinking this is a break even trade. then as it moves 9 ticks I move the stop again to just under the last tick low and in my mind I know I now have say 5 ticks locked away as profit. I keep on doing this readjustment. It makes you much less jumpy. Its actually easier to show you on a bar chart but have a look at this.

You can still be very aggressive with the exits but don't look at the current price rather at the last lows(for long trades). I find this very helpful because when you are going for small targets it is all to easy to bail out to soon. So in my mind when a trade goes my way by say 4 ticks then I am thinking this is a break even trade. then as it moves 9 ticks I move the stop again to just under the last tick low and in my mind I know I now have say 5 ticks locked away as profit. I keep on doing this readjustment. It makes you much less jumpy. Its actually easier to show you on a bar chart but have a look at this.