Dona Ferentes

Beware of geeks bearing grifts

- Joined

- 11 January 2016

- Posts

- 18,313

- Reactions

- 25,112

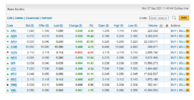

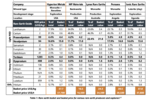

Round up the usual suspects.....The usual suspects AR3 ARR NTU REE VML.

.... I see AR3 is getting close to $1.00, and no doubt @barney would like VML to be 10c. perhaps ARR may get to 20c, too.