- Joined

- 12 February 2009

- Posts

- 623

- Reactions

- 1

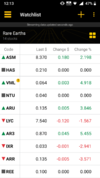

A somewhat backdoor play to ORM would be to buy MLM, IIRC they have a significant holding in ORM, as well as diversified holdings in other companies. MLM is also trading significantly below NTA, and has very large scandium holdings. I would buy in but lack of capital currently means I can only chase the companies I think have the shortest turn around time for a decent return, MLM seems to me to be a good long term play in minerals.

Hi PVF, thanks but to be honest, I can't think of anything worse than investing in a spec company which has diversified interests in other spec companies.

ORM is heavily focused on REEs. Yes MLM holds 30% and has the same directors, but that doesn't mean that it's share price will move (as has been the case). As REE is the hot sector, why diversify through a company like MLM? And if anybody does wish to diversify, why not just invest less in ORM and spend the rest on whichever ASX companies you choose?

One of the reasons why I am attracted to ORM is that MLM own 30% ie less free float about (Top 20=80%). This means that on good results from the upcoming drills, ORM should fly at MLM's expense.