Did not work,, a 6 months holding is listed as 119 bars (roughly the number of open days)

Is your second screen shot supposed to be daily?

I have the first settings ,i added the xao reference etc but still show me bars for days and not weeks

No. This is a weekly only system.

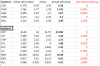

Only showing difference when toggling "Pad" setting.

Ticked = Weekly Bars.

No Tick = Daily Bars.

ALL other results identical.