- Joined

- 8 June 2008

- Posts

- 13,228

- Reactions

- 19,518

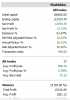

It will be income indeed, same taxation , probably in a company to get the 33pc ..as an individual it would be worse, and it will not take long to reach 33pc tax rate especially if these profits are reinvested: you need some other income to buy food and pay ratesWhat about husband and wife running it as a business and splitting tax on profits in stead of capital gains?.

You may not split income that easily...just saying that a backtest result is 60pc lower in real world just after considering tax here.

And that any business is facing similar issues,less pronounced as you can reinvest some gain into machinery etc but whole business areas face the same problem as above

The point is: in a place like Australia, unless you can benefit from the super system..and for how long?, you are facing a very unfair battle if only with tax rates in place

So back to the only Australian game buy real estate and flip it after 5 years or bank shares..a nation moving toward a bright innovative future