- Joined

- 2 May 2007

- Posts

- 4,745

- Reactions

- 3,002

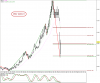

I am sure some of you have noticed the turnaround of PEN. My suspicion is the short term traders have returned. Real investors are still holding.

Any way I got this report from Intersuisse as a part of daily communique which they send to thousands of people enrolled with them.

What impressed me the line I have highlighted for PEN holders to read and note.

On 16 March 2011 06:42, xxxx @intersuisse.com.au> wrote:

Good morning,

Overnight news from Overseas.

Last night on global markets there was initially panic selling following media reports that sensationalised the Japanese power plant problems. We have seen a technical report that outlines the construction of the reactor concerned and the various processes that are being conducted to stabilise the shut down core. If correct, the report predicts that the cores will be stable within a day or so.Buyers returned to share markets which then closed above their lows for the day. The French market was down 2.5%, Germany 3.2%, the UK 1.4% and the Dow 0.8%. Copper fell 67 to 9118, nickel was 1115 lower at 24,705 and zinc lost 47 to 2282. Oil plunged 4.01 to 97.18, gold was sold down 32.10 to 1392.80 and our dollar fell to 99.18.

The US Federal reserve met and noted that employment and consumer spending were improving but kept stimulus actions in place.

Local News.

Our resources analyst, Pieter Bruinstroop, notes that companies in China have had limitations on borrowing and have been running down inventories of metals rather than buying more. This has stabilised metal prices so far this year but their inventory will not last too long and metal buyers will return to the market, driving prices higher again.

-

Today’s futures trading indicates a 13 point rise at our opening but this is not showing on our screen of individual stocks. An unpredictable day lies ahead with sellers and bargain hunters in play.Regards

Intersuisse Limited

Disclaimer : DYOR . It is not a recommendation from Intersuisse, me or any one. Seek Financial Advise and DO NOT rely on the extracted information which is a general commentary only

Any way I got this report from Intersuisse as a part of daily communique which they send to thousands of people enrolled with them.

What impressed me the line I have highlighted for PEN holders to read and note.

On 16 March 2011 06:42, xxxx @intersuisse.com.au> wrote:

Good morning,

Overnight news from Overseas.

Last night on global markets there was initially panic selling following media reports that sensationalised the Japanese power plant problems. We have seen a technical report that outlines the construction of the reactor concerned and the various processes that are being conducted to stabilise the shut down core. If correct, the report predicts that the cores will be stable within a day or so.Buyers returned to share markets which then closed above their lows for the day. The French market was down 2.5%, Germany 3.2%, the UK 1.4% and the Dow 0.8%. Copper fell 67 to 9118, nickel was 1115 lower at 24,705 and zinc lost 47 to 2282. Oil plunged 4.01 to 97.18, gold was sold down 32.10 to 1392.80 and our dollar fell to 99.18.

The US Federal reserve met and noted that employment and consumer spending were improving but kept stimulus actions in place.

Local News.

Our resources analyst, Pieter Bruinstroop, notes that companies in China have had limitations on borrowing and have been running down inventories of metals rather than buying more. This has stabilised metal prices so far this year but their inventory will not last too long and metal buyers will return to the market, driving prices higher again.

-

Today’s futures trading indicates a 13 point rise at our opening but this is not showing on our screen of individual stocks. An unpredictable day lies ahead with sellers and bargain hunters in play.Regards

Intersuisse Limited

Disclaimer : DYOR . It is not a recommendation from Intersuisse, me or any one. Seek Financial Advise and DO NOT rely on the extracted information which is a general commentary only