- Joined

- 17 March 2011

- Posts

- 365

- Reactions

- 8

Late post to the party I know but I agree with tech/a.

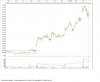

I wouldn't trade it until it has moved above that previous high (absolute high), and even then, I would want to know what the background looks like in order to understand risk v reward scenario.

). It's very likely that the supply identified by the 18/2 bar and today's bar is from people selling to get out off a trade that has been losing for almost a year. Now with that info. I would say that the BO setup was a poor one to trade knowing this background. Lesson: Look at a chart with more data points, even a short term trader.

). It's very likely that the supply identified by the 18/2 bar and today's bar is from people selling to get out off a trade that has been losing for almost a year. Now with that info. I would say that the BO setup was a poor one to trade knowing this background. Lesson: Look at a chart with more data points, even a short term trader.