tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,454

- Reactions

- 6,520

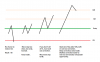

It's all portfolio management with the goal

To giving us a better Reward to Risk.

A few ticks here and there isn't going to

Skew figures massively. Sometimes it could

Keep you in a longer term successful trade

Others it could take you out with no loss.

With an abundance of prospects and a solid

Re entry strategy aggressive management should

Give high R/R provided we let good trades run.

To giving us a better Reward to Risk.

A few ticks here and there isn't going to

Skew figures massively. Sometimes it could

Keep you in a longer term successful trade

Others it could take you out with no loss.

With an abundance of prospects and a solid

Re entry strategy aggressive management should

Give high R/R provided we let good trades run.