- Joined

- 14 February 2005

- Posts

- 15,099

- Reactions

- 16,884

I knew it was silly to think they just need to drill a couple of holes in an entire field

My basic point is that oil differs from most other commodities in terms of how a resource is extracted.

Anything mined as a solid material - you build a mine that produces (for example) 5 million tonnes per year based on a 50 million tonne resource. It then does just that, you get 5 million tonnes of the stuff every year for the next 10 years and it's at a pretty constant rate until very close to the end. It's not quite constant but it's reasonably close.

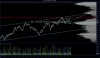

Oil differs in that production tapers off over time from any given field and doesn't have the "flat" profile that most other things do. Whatever flow you get at the start, pretty quickly that comes down unless you keep drilling more and more wells to tap surrounding deposits (or to inject water, CO2 etc to enhance oil recovery).

So oil is very much a case of having to keep investing just to maintain a constant output. The world is producing somewhere around 96 million barrels per day at the moment (varies a bit depending on the data source). If we stop all investment in new wells etc tomorrow, then that figure will start coming down almost immediately.