- Joined

- 12 February 2012

- Posts

- 410

- Reactions

- 29

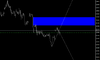

I believe finally it is time to avoid NZD. Overvalued NZD could tumble against USD. It will go down against AUD as well. I also believe NZD will have one of the biggest corrections during next 18 months. Just like stock and commodity market we could see long awaited shift in the currency cycle in the near future. NZD is number one over valued currency in the world followed by AUD and CAD. These three currencies could have bigger drop at any time now.

My ideas are not a recommendation to either buy or sell any security, commodity or currency. Please do your own research prior to making any investment decisions.

My ideas are not a recommendation to either buy or sell any security, commodity or currency. Please do your own research prior to making any investment decisions.