- Joined

- 7 May 2008

- Posts

- 69

- Reactions

- 0

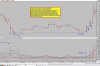

... how to tell the difference?

Can anyone provide any clues to newbies on how to tell the difference between a normal reaction and the beginnings or a stock's reversal?

I recently sold off a junior stock in Canada's very frothy potash market when the market seemed to be getting way too overheated and it started to sound like the big guys' exit strategies getting to work (i.e., "buy this stock because I want to get out"). When the stock had a reaction, I sold to lock in profits, not sure if the potash market was about to tank. As it turned out, the stock still had a few legs to go.

While I can't regret making a profit, are there are any simple, technical ways of looking at it, especially for someone who is just now learning technical analysis? (I promise, I'm studying hard, especially volume-spread analysis.)

Many thanks for any help.

Can anyone provide any clues to newbies on how to tell the difference between a normal reaction and the beginnings or a stock's reversal?

I recently sold off a junior stock in Canada's very frothy potash market when the market seemed to be getting way too overheated and it started to sound like the big guys' exit strategies getting to work (i.e., "buy this stock because I want to get out"). When the stock had a reaction, I sold to lock in profits, not sure if the potash market was about to tank. As it turned out, the stock still had a few legs to go.

While I can't regret making a profit, are there are any simple, technical ways of looking at it, especially for someone who is just now learning technical analysis? (I promise, I'm studying hard, especially volume-spread analysis.)

Many thanks for any help.