- Joined

- 22 November 2010

- Posts

- 3,661

- Reactions

- 11

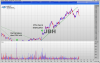

Care to put that on a chart Burglar?

Cheers Sir O

I had accepted your challenge!

I had put it on a chart.

Due to my computer being riddled by corrupted files I am unable to display it here!

The line I drew was a straight line touching lows of mid Feb2013, late Jun, late Jul and end Oct2013.

It did indeed, slice through a large red candle in mid Nov2013 at around $21.50

Cheers burglar