You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Neilson Smart Money Analyser: POTENTIAL price action

- Thread starter moses

- Start date

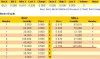

Back to my favourite, BLG.

Seller are drying up, but look at the smart money...why is it dropping?

Check the depth (rule no. 1).

Because a smart seller is hoping for a spike to pick up a quick 70c?

That looks bullish to me, but you be the judge...

a) smart money buying pressure has been positive for several days.

b) sellers are disappearing

c) the smart selling pressure is right at highest price

d) volume is up

e) price was up 9% on Monday

f) SP is testing old highs, ie, about to break out

Seller are drying up, but look at the smart money...why is it dropping?

Check the depth (rule no. 1).

Because a smart seller is hoping for a spike to pick up a quick 70c?

That looks bullish to me, but you be the judge...

a) smart money buying pressure has been positive for several days.

b) sellers are disappearing

c) the smart selling pressure is right at highest price

d) volume is up

e) price was up 9% on Monday

f) SP is testing old highs, ie, about to break out

Attachments

- Joined

- 27 April 2006

- Posts

- 523

- Reactions

- 1

If the "Smart Money" was that smart would they be advertising the fact?

Thought we had been down this road before in other threads.

Besides you can buy and own for life TraderGuide for $AU1200 -- which is 2 years sub to this mob.

Cheers

Thought we had been down this road before in other threads.

Besides you can buy and own for life TraderGuide for $AU1200 -- which is 2 years sub to this mob.

Cheers

I like INL (see INL thread) and TFE, but the rest look pretty crap!mhtrieu said:Hey Moses,

Can i please get a SMA chart for AXO, TFE, EBT, ALD and INL

Attachments

On the 18th I posted this on the FDL thread here along with a SMA chart.

Since then the SP has moved up by 21% from 0.014c to 0.017c. DYOR because there is some hard feelings expressed about this stock, but with the volume up like this it may just be worth a closer look.

Something has changed at FDL. Somebody appears to be soaking up shares and holding the SP at .015-.014c.

Why? What do they know?

Meanwhile, here is the evidence. First the SMA chart shows that buying pressure suddenly rose and has held flat since late January. The current market depth confirms this with a massive amount of buys at .014c. And the candlesticks show that virtually every day since late Jan the price started or finished at .015c, and finally the volume slightly increased once .015c was reached.

So...it appears that somebody is a believer at least! What think ye?

Since then the SP has moved up by 21% from 0.014c to 0.017c. DYOR because there is some hard feelings expressed about this stock, but with the volume up like this it may just be worth a closer look.

Attachments

coyotte said:If the "Smart Money" was that smart would they be advertising the fact?

Yep Its more like the dum money or follow me you d''''heads.

Depth lists below the top 2 or 3 at max are just an allusion.

Want to see magic? Watch a big number disappear as it gets close to the top.

Have fun

Bob.

Bobby said:coyotte said:If the "Smart Money" was that smart would they be advertising the fact?

Yep Its more like the dum money or follow me you d''''heads.

Depth lists below the top 2 or 3 at max are just an allusion.

Want to see magic? Watch a big number disappear as it gets close to the top.

Have fun

Bob.

Surely there is smart and smart?

Agreed, the really smart traders hide their hand; but we all know that the easiest way to buy on dips is to have an order sitting there waiting. Sure, all the SMA does is give a value weighting to the orders sitting on hand to indicate which way the buying pressure is blowing, but surely that is useful information, even if only as a first pass?

So long as we don't imagine that these indicators are a magic black box trading system then its gotta be a lot of fun!

Tell me more...I can't find it on Google.coyotte said:Besides you can buy and own for life TraderGuide for $AU1200 -- which is 2 years sub to this mob.

tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,432

- Reactions

- 6,418

coyotte said:If the "Smart Money" was that smart would they be advertising the fact?

Thought we had been down this road before in other threads.

Besides you can buy and own for life TraderGuide for $AU1200 -- which is 2 years sub to this mob.

Cheers

Absolutely coyotte.

For anyone to think that a $15,000 bid or ask sitting in a que is "Smart money" (The new buzz word) is not that smart.

Smart money comes from Insto's and Syndicates. When they buy/sell they will do it at a level and in a VERY liquid stock and it WONT be in one block but MANY and it will be indecernable to those watching depth.

Moses.

Have a look at those that DONT COME OFF.

Bet you'll find those that do generally are more liquid stocks.

Tradeguider shows BLG as a normal stock in a normal up trend.

As an aside.

Kris my son who is a Physist specialising in Photonics and Lasers tells me Blueglass technology is THE next generation in hardware technology and when implemented will be like going from prop to jet!!

Kris and I have help BLG since 35c and will hold and hold and hold,I'm backing the Physist for my smart money!!---on THIS one.

Attachments

- Joined

- 27 April 2006

- Posts

- 523

- Reactions

- 1

Moses:

Sorry put the "r" in the wrong spot.

This is the Vol Analyst Program that Nick & Tech/A are going on about.

http://www.tradeguider.com/

Cheers

Sorry put the "r" in the wrong spot.

This is the Vol Analyst Program that Nick & Tech/A are going on about.

http://www.tradeguider.com/

Cheers

Thanks, I'll chase it up.coyotte said:Moses:

Sorry put the "r" in the wrong spot.

This is the Vol Analyst Program that Nick & Tech/A are going on about .

http://www.tradeguider.com/

Cheers

- Joined

- 20 November 2005

- Posts

- 787

- Reactions

- 92

If I understand the Neilson indicator correctly, its based on market depth? (please correct me if I'm wrong). Market Depth however can be manipulated (consciously or not) with relative ease which would then put into question the validity of the indicator itself. IMHO the only true indicator of sentiment is committed volume or actual traded volume. Anything else is a misnomer.

Regards

Regards

tech/a said:Absolutely coyotte.

For anyone to think that a $15,000 bid or ask sitting in a que is "Smart money" (The new buzz word) is not that smart.

Smart money comes from Insto's and Syndicates. When they buy/sell they will do it at a level and in a VERY liquid stock and it WONT be in one block but MANY and it will be indecernable to those watching depth.

...meaning you object to the use of "smart" to describe whatever signal it is that the SMA is picking up from the end of day depth, because the really smart guys aren't there. Fair enough (it wasn't my idea anyway), but what would you prefer to describe it as? Can we pick a better buzzword that won't irritate people?

Of course. Like blue chips; thats in the guide.Moses.

Have a look at those that DONT COME OFF.

Bet you'll find those that do generally are more liquid stocks.

Several of my colleagues are astro-physicists, and two from Macquarie; one put me on to BLG and I immediately saw the potential. So I've held BLG since 38c, and even traded it profitably once or twice (just briefly when I needed the cash and thought I could get away with it). But you're right; this is one to hold for the ride and not let go.Tradeguider shows BLG as a normal stock in a normal up trend.

As an aside.

Kris my son who is a Physist specialising in Photonics and Lasers tells me Blueglass technology is THE next generation in hardware technology and when implemented will be like going from prop to jet!!

Kris and I have help BLG since 35c and will hold and hold and hold,I'm backing the Physist for my smart money!!---on THIS one.

Hi Nick,Nick Radge said:If I understand the Neilson indicator correctly, its based on market depth? (please correct me if I'm wrong). Market Depth however can be manipulated (consciously or not) with relative ease which would then put into question the validity of the indicator itself. IMHO the only true indicator of sentiment is committed volume or actual traded volume. Anything else is a misnomer.

Regards

Yes it is based on market depth at the end of the day.

However, to your argument, you would surely agree that the validity of *every* indicator must be called into question. Its been pointed out, and there is more information in the "traps for beginners" guide, that there are several things that can distort the signal, and will, so it is important to understand why the signal exists to determine its significance.

And so far as indicators for sentiment are concerned...as important as we all know actual traded volume is for a signal, its big weakness is that it is *history*, whereas we want to know the future.

- Joined

- 27 April 2006

- Posts

- 523

- Reactions

- 1

...meaning you object to the use of "smart" to describe whatever signal it is that the SMA is picking up from the end of day depth, because the really smart guys aren't there. Fair enough (it wasn't my idea anyway), but what would you prefer to describe it as? Can we pick a better buzzword that won't irritate people?

It's not irritating Moses, it's misleading --- like the saying "Dumb Money Opens and Smart Money Closes" is also misleading.

Cheers

It's not irritating Moses, it's misleading --- like the saying "Dumb Money Opens and Smart Money Closes" is also misleading.

Cheers

Fair enough.coyotte said:It's not irritating Moses, it's misleading --- like the saying "Dumb Money Opens and Smart Money Closes" is also misleading.

- Joined

- 18 January 2007

- Posts

- 62

- Reactions

- 0

Is it just me or Is the SMA slow to update todays numbers??

Similar threads

- Replies

- 12

- Views

- 2K

- Replies

- 38

- Views

- 4K

- Replies

- 10

- Views

- 4K

- Replies

- 50

- Views

- 5K