Not all bearish signals are bears, which is why it is important to DYOR. When I first saw the ASX chart I almost freaked; but I soon found that that the ASX is rumoured to be take over target by Mac and NYSE. The strong smart money selling pressure is not so much indicating a likely fall in SP but a good time for all investors to take a profit.

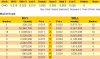

(Note the date says Monday, but the last data is Friday evening.)

(Note the date says Monday, but the last data is Friday evening.)