- Joined

- 3 June 2013

- Posts

- 457

- Reactions

- 53

Hi KTP,

Interesting analysis. A couple of points:

1. As you have pointed out the Z Score uses the Market Value of Equity in the calculation, I personally think the Private Business version of the Altman Z Score which uses the Book Value of Equity instead of Market Value of Equity is more suitable for some listed companies to remove the effect of market volatility/illiquidity on the results (i.e. ignore the market!). Note Altman did research into proving his Private Business (and Foreign Markets) version of the Altman Z Score and provides the results in the paper. Revisiting your calculations by applying the Private Business version of the Altman Z score might be an interesting exercise.

2. For me the paper took some digesting, but I came to the conclusion that the Z score is a useful tool for certain turnaround situations and it is interesting to see his checks 30+ years later to see how effective the original formula has been. IMO, selecting an appropriate Z score formula, careful selection of cut-off and trending the Z score over time can provide insight into a possible turnaround (note I found on the web a business academic recommending it as a management KPI tool).

Cheers

Oddson

Hi Oddson,

I haven't read the paper yet, but I will once I get some time.

Using book value instead of market value does not seem to make much sense to me - Total Assets and Total Liabilities are already inputs into the ratio, so using Net Assets would seem to be measuring similar things, giving them a higher weighting. Market value makes more sense to me, as it measures "sentiment".

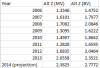

Nevertheless, here are the results using both Market Value (MV) and Book Value (BV) side by side:

Giving a much rosier picture.

There are 3 things in Alt Z calculation, that, in my opinion, potentially give a lower score to PMP than it may currenly deserve:

1. Market price - as seen above, it has no direct correlation with financial stability.

2. Net Assets - Alt Z formula uses Revenue/Net Assets, meaning that company with more assets will get a lower score. Last year, PMP sold off some underperforming assets, and this margin will improve significantly once restructuring costs are removed.

3. Retained Earnings being negative. This is a matter of time, probably 3-4 years. The money was spent long ago, on bad acquisitions. Writing off goodwill now has absolutely no effect on the stability of the company. As long as they keep avoiding acquisitions, as they've been doing for the past few years, this is a non-factor. Using my projection numbers, should retained earnings have been +20, instead of -100, score would have been above 3, meaning Nil chance of bankruptcy.