Garpal Gumnut

Ross Island Hotel

- Joined

- 2 January 2006

- Posts

- 14,068

- Reactions

- 11,250

Re: MBL - Macquarie Bank

I couldn't agree more.

The house that debt built.

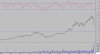

Enclosed is a chart showing previous support and resistance in the low 40 level.

I wouldn't be surprised if it tested that again in the next few weeks.

Garpal

Cheers Joe, it's been a dramatic fall out.....

I expected some fairly heavy selling, but MBL is where it was some two years ago in four weeks. I was expecting 70 as a first target, not 62. I also expected it would take a lot longer! Still, it's not the heaviest sold of investment bank - BNB and AFG have actually fared worse, and I much prefer BNB model from an operational perspective from MBL's.....

Interestingly, MBL have been the only ones not saying a thing about their exposure to the liquidity crisis - any rally IMO is a selling op, I would have thought there is more bad news to come from the "house that debt built"!

All the best guys, difficult trading conditions for anyone but the short seller ATM.

Cheers

I couldn't agree more.

The house that debt built.

Enclosed is a chart showing previous support and resistance in the low 40 level.

I wouldn't be surprised if it tested that again in the next few weeks.

Garpal