- Joined

- 13 September 2013

- Posts

- 988

- Reactions

- 531

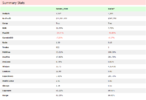

Beginning of month 17

Small loss for December. 1 of my positions also never entered as well, so I only held 9 not 10. Not too worried. I've had a good run for positive months and not every month can be a winner. Also still smashing the index right now, so happy.

Current yearly return: 39%

Sharpe: 1.1

This month, -1.7% vs XKO gaining 3%

5 new positions for this month.

View attachment 135324

View attachment 135325

Awesome mate! good to see I long-term live equity graph ?