@Cam019

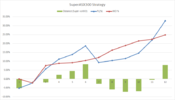

Are you looking at using Radge's system? I do recommend it. My super is small but growing quickly. This system is scalable to a large size which is one of the reasons why I like it. (scalable by being able to add more positions which helps the downside risk, and being monthly meaning positions sizes can be large-ish.)

Are you looking at using Radge's system? I do recommend it. My super is small but growing quickly. This system is scalable to a large size which is one of the reasons why I like it. (scalable by being able to add more positions which helps the downside risk, and being monthly meaning positions sizes can be large-ish.)