- Joined

- 30 November 2022

- Posts

- 29

- Reactions

- 47

I'm rather new to buying shares on the ASX. My broker is CMC markets.

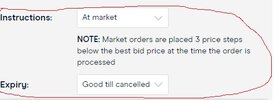

I noticed that when you go to execute a buy or sell order at 'market' then for buy orders you're charged 3 Price steps above the highest bid, and for

selling you're filled at at least 3 Price Steps below the highest offer. Is this 3 price step rule a way of gleaning a higher spread from the buyer or seller?

Do all brokers do this?

I noticed that when you go to execute a buy or sell order at 'market' then for buy orders you're charged 3 Price steps above the highest bid, and for

selling you're filled at at least 3 Price Steps below the highest offer. Is this 3 price step rule a way of gleaning a higher spread from the buyer or seller?

Do all brokers do this?