CanOz

Home runs feel good, but base hits pay bills!

- Joined

- 11 July 2006

- Posts

- 11,543

- Reactions

- 519

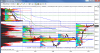

DAX homework for today.

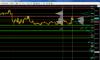

With Asian down over 2% and the US futs down nearly .5% before the open in Europe, we could expect a GAP down to 6600. If this happens we have the previous value area above that could be tested, and perhaps a GAP fill. We'll look to fade that move if it takes place after the London open when we see how the market reacts to the test and perhaps try to stay in for a move much lower today. If this does not play out we will wait and look for where the initial balance forms and then decide if we would range trade or look for the clues of another trend day later on.

The chart shows are significant areas of support and resistance today, where we will look for trading opportunities as the market direction becomes a little clearer. There are also a couple of areas of support to be tested below 6560...

No news until later this evening.

Cheers,

CanOz

With Asian down over 2% and the US futs down nearly .5% before the open in Europe, we could expect a GAP down to 6600. If this happens we have the previous value area above that could be tested, and perhaps a GAP fill. We'll look to fade that move if it takes place after the London open when we see how the market reacts to the test and perhaps try to stay in for a move much lower today. If this does not play out we will wait and look for where the initial balance forms and then decide if we would range trade or look for the clues of another trend day later on.

The chart shows are significant areas of support and resistance today, where we will look for trading opportunities as the market direction becomes a little clearer. There are also a couple of areas of support to be tested below 6560...

No news until later this evening.

Cheers,

CanOz