As the white gold roars (Lithium) so do a few today as everybody scrambling for supplies I’m watching closely MRR , AS2 , BNR just to many green on the screen . Australia in a good position to keep up with new discoveries more research need always dyor &DD Springs

JohnDe

La dolce vita

- Joined

- 11 March 2020

- Posts

- 4,614

- Reactions

- 6,835

As the white gold roars (Lithium) so do a few today as everybody scrambling for supplies I’m watching closely MRR , AS2 , BNR just to many green on the screen . Australia in a good position to keep up with new discoveries more research need always dyor &DD Springs

Those three aren't big into lithium, more like a 'look I have some' than anything else. Price rise is more likely their size in Gold, copper and Nickel.

But yes, there is signs of a huge lithium-rush and everyone wants in on it.

Be careful.

bk1

Follow the money

- Joined

- 28 June 2020

- Posts

- 305

- Reactions

- 328

One of the Directors of MRR, George Karageorge, was one of the original geologists on PLS.

They are looking in the right area with people who know what prospective pegmatites look like.

They are looking in the right area with people who know what prospective pegmatites look like.

bk1

Follow the money

- Joined

- 28 June 2020

- Posts

- 305

- Reactions

- 328

A lot of buying of BNR just before the trading halt today, up 30% on the day.

Hold

Hold

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,720

- Reactions

- 12,456

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,720

- Reactions

- 12,456

JohnDe

La dolce vita

- Joined

- 11 March 2020

- Posts

- 4,614

- Reactions

- 6,835

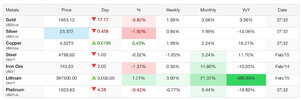

Some explanation here -

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,720

- Reactions

- 12,456

Some explanation here -

So, from the panel:

- Supply shortfall to remain.

- Takes a long time to bring new projects on.

- Uptake of EVs faster than expected.

- EVs are actually good, ICE vehicle makers didn't think they were any good.

- ICE vehicle makers late to the party and trying to catch up.

- Covid and supply issues raising prices.

- Labour force missing due to lockouts and Covid.

- Improved battery technology.

- Ni and Co expensive, Li was cheaper, more price increases to come.

- Not sure if new supply will match demand.

- May constrain new cars coming on.

- No current replacement for Li for battery tech, but others may be coming.

- Cost of Li in a battery not the major cost.

- Current prices not long term contracts but indicates supply demand situation.

- Toyota spending $70b on EVs by end of 2020s. Double of earlier target of 12 mths ago.

- Saudis pivoting and looking for supply.

- Ford doubled sale target for EV pickups - F150.

- Paradigm shift in US auto market and late to the party.

- Investment will speed things up but Li deposits not easy to bring into production.

- Many different types of deposit makes chemical process difficult. Every project different.

- More funding coming in compared to last run on Li. Traditional banks weren't financing. Now more interested.

- Demand much greater than possible supply.

- More Teslas's coming on.

- General battery storage use to significantly increase.

JohnDe

La dolce vita

- Joined

- 11 March 2020

- Posts

- 4,614

- Reactions

- 6,835

So, from the panel:

- Supply shortfall to remain.

- Takes a long time to bring new projects on.

- Uptake of EVs faster than expected.

- EVs are actually good, ICE vehicle makers didn't think they were any good.

- ICE vehicle makers late to the party and trying to catch up.

- Covid and supply issues raising prices.

- Labour force missing due to lockouts and Covid.

- Improved battery technology.

- Ni and Co expensive, Li was cheaper, more price increases to come.

- Not sure if new supply will match demand.

- May constrain new cars coming on.

- No current replacement for Li for battery tech, but others may be coming.

- Cost of Li in a battery not the major cost.

- Current prices not long term contracts but indicates supply demand situation.

- Toyota spending $70b on EVs by end of 2020s. Double of earlier target of 12 mths ago.

- Saudis pivoting and looking for supply.

- Ford doubled sale target for EV pickups - F150.

- Paradigm shift in US auto market and late to the party.

- Investment will speed things up but Li deposits not easy to bring into production.

- Many different types of deposit makes chemical process difficult. Every project different.

- More funding coming in compared to last run on Li. Traditional banks weren't financing. Now more interested.

- Demand much greater than possible supply.

- More Teslas's coming on.

- General battery storage use to significantly increase.

Yes.

As long as consumers still want to change over to EV’s and car manufacturers race to catch up to Tesla, Lithium demand will be high.

Anybody know why lithium stocks have fallen so much lately? For example Allkem, Liontown, AZL? I started investing in lithium and they literally plummeted into double digit negative immediately!Yes.

As long as consumers still want to change over to EV’s and car manufacturers race to catch up to Tesla, Lithium demand will be high.

JohnDe

La dolce vita

- Joined

- 11 March 2020

- Posts

- 4,614

- Reactions

- 6,835

Anybody know why lithium stocks have fallen so much lately? For example Allkem, Liontown, AZL? I started investing in lithium and they literally plummeted into double digit negative immediately!

I don’t know much about those miners. Did a quick search of LTR and the chart looks ok, the news is better. Maybe you invested at the wrong price point.

ASX adds 1.1pc: Liontown, Vicinity, CSL soar

Australian shares climb; China’s January factory inflation falls to slowest pace since July; Treasury Wine, Vicinity Centres, Pro Medicus leap; Netwealth, EML Payments dive; Liontown and Tesla sign lithium supply agreement. Follow the latest here.

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,720

- Reactions

- 12,456

Anybody know why lithium stocks have fallen so much lately? For example Allkem, Liontown, AZL? I started investing in lithium and they literally plummeted into double digit negative immediately!

A natural correction I would say. A lot of people have made a lot of money the past year on these and may have just thought it was time to take some money off the table. Stocks may have overshot their intrinsic or perceived value or there's worry that the price of lithium was turning into a bubble. The chart posted above does look very tulip-like. The major difference is there's some fundamentals behind the use of lithium compared to a flower. So, in my opinion, a healthy correction. Might see more downside as more profits are taken. A worst case scenario is the price of lithium takes a dive for a few weeks which will see punters run for the door, but a complete breakdown is very unlikely due to the dot points mentioned above. But, I'm not a lithium expert in the slightest. Learning myself.

- Joined

- 12 January 2008

- Posts

- 7,501

- Reactions

- 18,824

Big news overnight concerning the huge lithium miner Albemarle Corp (ALB-us). Stock price tumbles -20% after huge increase in capital costs was announced in their recent qrtly report. Production met guidance, sales beat guidance but capital expenditure went through the roof.

All is not perfect for lithium producers even with the booming lithium prices.

btw: The lithium ETF (LIT.us) holds 12.2% ALB and is it's largest holding. This price shock knocked LIT down a peg as well.

All is not perfect for lithium producers even with the booming lithium prices.

btw: The lithium ETF (LIT.us) holds 12.2% ALB and is it's largest holding. This price shock knocked LIT down a peg as well.

- Joined

- 3 November 2013

- Posts

- 1,605

- Reactions

- 2,862

Big news overnight concerning the huge lithium miner Albemarle Corp (ALB-us). Stock price tumbles -20% after huge increase in capital costs was announced in their recent qrtly report. Production met guidance, sales beat guidance but capital expenditure went through the roof.

All is not perfect for lithium producers even with the booming lithium prices.

btw: The lithium ETF (LIT.us) holds 12.2% ALB and is it's largest holding. This price shock knocked LIT down a peg as well.

Yes, I saw that and it looks like ALB lead falls in other lithium miners.

I haven't had time to look until the specifics but clearly this is an industry with lots of potential and risk.

Two major types of lithium mines exist - those that mine from ore (spodumene) and those extracting from brine.

The latter is almost exclusively in Chile (at this stage) which has had issues with water restrictions and the risk of mines being nationalised. (I believe ALB is in this camp but also owns a stake in a spodumene mine too).

bk1

Follow the money

- Joined

- 28 June 2020

- Posts

- 305

- Reactions

- 328

That would be the largest highest grade hard rock lithium mine in the world, Greenbushes.but also owns a stake in a spodumene mine too

49% JV.

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,720

- Reactions

- 12,456

- Joined

- 12 January 2008

- Posts

- 7,501

- Reactions

- 18,824

Don't take your eye's off the lithium prize. There were lots of high volume bullish bars in the lithium sector on Friday (18/3/22).

AZL, ESS, GLN, CXO, GL1, LTR, NMT, PLS, VUL (bleah), AGY, AVZ, EUR, INR, LEL, LKE, LPI, NVX, MNS etc . . .

That's a lot of money going back into this sector.

AZL, ESS, GLN, CXO, GL1, LTR, NMT, PLS, VUL (bleah), AGY, AVZ, EUR, INR, LEL, LKE, LPI, NVX, MNS etc . . .

That's a lot of money going back into this sector.

Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,720

- Reactions

- 12,456

JohnDe

La dolce vita

- Joined

- 11 March 2020

- Posts

- 4,614

- Reactions

- 6,835

- Joined

- 3 November 2013

- Posts

- 1,605

- Reactions

- 2,862

Here's to hoping Canadian suppliers will get a benefit....

Similar threads

- Replies

- 7

- Views

- 1K