- Joined

- 8 June 2008

- Posts

- 13,691

- Reactions

- 20,393

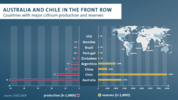

Green(er)lithium straight where it is needed, a serious competition for aussies miners.

"The geothermal process involves extracting super-hot lithium-rich brine from reservoirs 8,000 feet (2.4 km) underground and using the heat to produce electricity, after which lithium is extracted from the brine.

"The brine is then reinjected into the earth, making the process more sustainable than open-pit mines and brine evaporation ponds, the two most-common existing methods ... "

Is it a conflation to mix greener lithium with lower CO2 footprint? Is it the same thing?Green(er) lithium straight where it is needed, a serious competition for aussies miners. ... but in the other end, when competition is in OZ ..

While noone among producers really care about carbon footprint, it can be used by the competition especially from these hot springsIs it a conflation to mix greener lithium with lower CO2 footprint? Is it the same thing?

"open-pit mines and brine evaporation ponds" . The advantage for Oz is hard rock spodumene, but like most extractive industries, it seems a messy business. What are the concentrations of Lithium in the rock; about 1% to 1.5% tops? Current plans for the big 3 lithium hydroxide plants in WA are for concentration at mine site to about 6%, then shipment to the plants for processing. Wesfarmers and SQM are talking of 1 million tonnes of (benign) waste in tailings for the 50,000 tonne annual LiOH production. The others have similar numbers

Wesfarmers chief executive of chemicals, energy and fertilisers Ian Hansen said the producers believed a material known as delithiated beta spodumene could be repurposed instead of dumped, and is investigating if aggregate for road and building construction is viable. But at present, WES plans are to retruck the waste from Kwinana 550km back to the minesite.

Albemarle, which is well on the way to finishing its hydroxide plant at Kemerton, had to scrap plans to dump the tailings at a tip site near the farming town of Dardanup after a backlash from local residents. Chris Ellison’s Mineral Resources, Albemarle’s junior partner in the Kemerton plant and the mothballed Wodgina lithium mine in the Pilbara, has since proposed carting the waste more than 550 kilometres out to its iron ore operations at Koolyanobbing.

Tianqi and partner IGO are due to start commissioning of their Kwinana plant and start production in late 2021. Not sure where their aluminosilicate waste will go.

The WA Environmental Protection Authority has approved plans for the tailings, but is there a better solution?

Pilbara Minerals are investigating the possibility of higher concentration of Lithium salts up to 35% through electric calcination (using Calix CLX technology) on site, such that the aluminosilicate waste remains on site (backfill?) then shipping concentrate to the processor. Of course, the PLS processor is in South Korea, so that is an upstream loss for WA.

"This buoyancy of the lithium price follows on from the market tightening as the electric vehicle ("EV") revolution accelerates, demand has eroded the oversupply seen in 2019 and 2020."

"This tightness in the market is expected to continue, with Credit Suisse saying that lithium demand might treble by 2025 from 2020 levels and that supply would be stretched to meet that demand, but higher prices were needed to incentivise the required supply response."

"World demand for lithium is forecast to increase from 305,000 tonnes lithium carbonate equivalent ("LCE") in 2020 to 452,000 tonnes in 2021 (48% increase YOY)."

"However global EV sales are expected to exceed 4.6 million in 2021 vs 3.2 million units in 2020, which would be a 44% increase for the year, which is comparable to the 43% increase from 2019 to 2020."

"The consequence of this dramatic change in consumer behaviour is that in 2023, demand for lithium is forecast to increase at a CAGR of 30% to 675,000 tonnes LCE from 2020 levels."

"By 2030, global battery demand is expected to increase 14-fold by 2030 with Statista estimating lithium demand of 1.8 million tonnes by 2030."

Lithium prices are rising as demand for the key ingredient in electric car batteries grows, amid a broader push to move away from oil and gas. But extraction of the metal is time consuming and potentially harmful to the environment, and plans to produce more have prompted protests.

think of an Li battery like a bookshelf with many layers, and the lithium ions rapidly move across each shelf, cycling back each time to the top shelf – a process called intercalation. After years and years, the bookshelf naturally starts to break down and collapse. So when chemists like Meng dismantle an Li battery, that's the sort of degradation they see in the structure and materials.

"We can actually find the mechanisms, [and] either using heat or some kind of chemical treatment method, we can put the bookshelf back [together]," says Meng. "So we can let those recycled and refurbished materials go back to the assembly line to the [Li battery] factories to be made into new batteries."

Lithium Australia NL (LIT, formerly Cobre Montana NL) is a developer of disruptive lithium extraction technologies. LIT has strategic alliances with a number of companies, potentially providing access to a diversified lithium mineral inventory. LIT plans for Energy-efficient recovery of lithium from mine waste to create primary battery chemicals, Conversion of those primary battery chemicals into cathode materials via VSPC Ltd and recycling of energy metals from spent LIBs and alkaline batteries, via Recycling and VSPC.

Nuts, but there's a fundamental shift here, coupled with a supply shock, cheap money and political will for Green energy.

Yep, I get the fundamental position with lithium, but haven't we done this before? There are some lithium stocks that are, and will, produce lithium, but there's a lot who are just jumping on the bandwagon, with zero fundamentals. It's the uranium run in 2006/07 ish over again. The music stops. Play the game, but make sure you have a chair.

True, it does remind me when crypto became a new thing and several companies were changing their names to include "block chain" or "crypto", resulting in massive gains on the markets.Yep, I get the fundamental position with lithium, but haven't we done this before? There are some lithium stocks that are, and will, produce lithium, but there's a lot who are just jumping on the bandwagon, with zero fundamentals. It's the uranium run in 2006/07 ish over again. The music stops. Play the game, but make sure you have a chair.

Also I've got Neometals NMT:ASX in the 2022 ASF Tipping.I believe that the recycling of Lithium batteries will not be a problem, because we have time on our side. The majority of EV battery packs are good for 10+ years.

There are many companies like LIT Lithium Australia that are making recycling part of their long term business plan and have patented technologies.

And then there's the life cycle of the batteries; when no longer viable for EVs they are repurposed for electricity storage packs, like the one in SA built by Tesla, and home power storage.

Now is the time time for investors to look for the companies that will be able to take advantage of the battery future and recycling.

Maybe we can make a list of listed companies. I've been a holder of LIT for several years, they have the technology, now they just need o implement it on a large scale.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.