tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,400

- Reactions

- 6,317

I'm often asked WHY technical analysis.

For me I'm a visual person I like to see it.

After looking at 10s of 1000s of charts I can almost instantly read a chart to the point of "am I interested"

Nothing in my life is Grey.

Its Black or White True or False Right or Wrong.

Charts convey exactly that.

I can be definitive in my decision making process and know quickly if I'm Right/Wrong or stuck in "The Grey Zone"

I see charts as analysis of crowd behaviorin investment within that instrument.

I can see Fear/Greed/Agreement/Disagreement and uncertainty.

I can define where these points are. How long they have been in control and where they could possibly end or begin.

I also understand the value of frequency. If you can get it right often and long enough and get out of Grey or Wrong quick enough you are likely to find greater profit.

Charting allows me the opportunity to do this.

More so when trading in a discretionary manner---which this following work on Technical Analysis (T/A) will be based around. Sure those inclined may use some/all or variants of what I put up to include in a Trading system which will return various parameters from testing.

I need to be able to define and diminish RISK

THIS (RISK MANAGEMENT) is the single most important tool of trade you can have.

I suggest all traders gain a PHD in risk management and mitigation. It will serve you well and keep you in the business of trading long long after the "Smart buyers and Clever Sellers" have disappeared

Charting ---- T/A allows me the luxury of being DEFINITIVE in my management of risk.

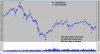

I will presume that all reading at least understand a BAR CHART as these are the charts I will use.

Range

Gaps

Volume

Support/Resistance

Close

Momentum

Breakouts

Short/Long

Position sizing

Expectancy

Are all terms I suggest you goggle if your not sure of their place in T/A---all will be on the menu.

I will be using a great number of Charts and notations and eventually we will have some trades to work with. I will be looking at shorter time frame from Day trading to a week or so.---

Our aim is to identify opportunity --- to anticipate a move in our direction and take advantage of it. if we are right stay right for as long as our analysis anticipates further momentum in our direction all the while mitigating Risk and maximising profit. If Wrong----dont stay Wrong for TOO LONG!.

Finally

Joe has agreed to lock this thread I will be able to access for updates and then close again.

If anyone DOESN'T UNDERSTAND that there is a separate Q&A thread ALREADY going their post will be moved over to it by Joe.

Then I hope the thread can remain cohesive.

Ill hopefully have time to kick off on the weekend.

For me I'm a visual person I like to see it.

After looking at 10s of 1000s of charts I can almost instantly read a chart to the point of "am I interested"

Nothing in my life is Grey.

Its Black or White True or False Right or Wrong.

Charts convey exactly that.

I can be definitive in my decision making process and know quickly if I'm Right/Wrong or stuck in "The Grey Zone"

I see charts as analysis of crowd behaviorin investment within that instrument.

I can see Fear/Greed/Agreement/Disagreement and uncertainty.

I can define where these points are. How long they have been in control and where they could possibly end or begin.

I also understand the value of frequency. If you can get it right often and long enough and get out of Grey or Wrong quick enough you are likely to find greater profit.

Charting allows me the opportunity to do this.

More so when trading in a discretionary manner---which this following work on Technical Analysis (T/A) will be based around. Sure those inclined may use some/all or variants of what I put up to include in a Trading system which will return various parameters from testing.

I need to be able to define and diminish RISK

THIS (RISK MANAGEMENT) is the single most important tool of trade you can have.

I suggest all traders gain a PHD in risk management and mitigation. It will serve you well and keep you in the business of trading long long after the "Smart buyers and Clever Sellers" have disappeared

Charting ---- T/A allows me the luxury of being DEFINITIVE in my management of risk.

I will presume that all reading at least understand a BAR CHART as these are the charts I will use.

Range

Gaps

Volume

Support/Resistance

Close

Momentum

Breakouts

Short/Long

Position sizing

Expectancy

Are all terms I suggest you goggle if your not sure of their place in T/A---all will be on the menu.

I will be using a great number of Charts and notations and eventually we will have some trades to work with. I will be looking at shorter time frame from Day trading to a week or so.---

Our aim is to identify opportunity --- to anticipate a move in our direction and take advantage of it. if we are right stay right for as long as our analysis anticipates further momentum in our direction all the while mitigating Risk and maximising profit. If Wrong----dont stay Wrong for TOO LONG!.

Finally

Joe has agreed to lock this thread I will be able to access for updates and then close again.

If anyone DOESN'T UNDERSTAND that there is a separate Q&A thread ALREADY going their post will be moved over to it by Joe.

Then I hope the thread can remain cohesive.

Ill hopefully have time to kick off on the weekend.